In shaping India’s financial and corporate landscape, Chartered Accountants (CAs) and Company Secretaries (CSs) are essential. Their major devotion is to ensure accurate financial reporting, comply with intricate norms, and propose strategic counsel to businesses. However, it is difficult to manage such responsibilities, particularly with the successive modification of the tax framework and workloads. To curb such difficulties SAG Infotech’s Genius tax software steps in as a valuable asset for the CAs and CSs, facilitating their procedure and enabling them to focus on providing high-value services.

How Genius Software Are Benefits for Tax Compliance Work?

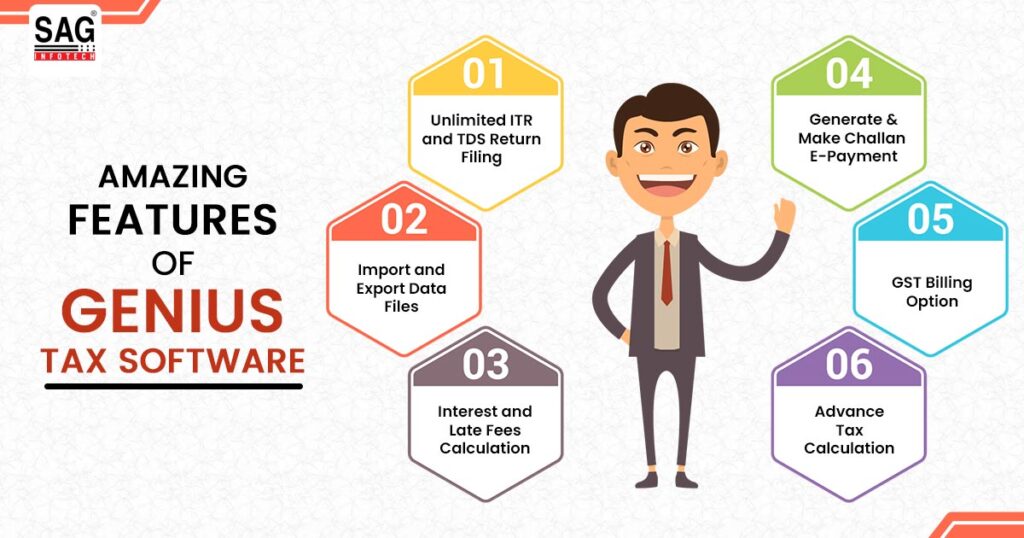

Genius software provides the benefit of automating time-consuming tasks associated with tax and accounting. Features such as:

Unlimited Filing of Tax Returns

It is easy for you to add more and more clients to the filing software and file their income tax returns. As an individual account, the software shall add each client and keep the data separate between each account to create.

Easily and Quickly Tax Return Filing

The software integrates easily with government e-filing portals, permitting the effortless filing of diverse tax returns directly through the platform.

User-Friendly Software Interface

For CA it is easy to execute, practice and is adaptable to the company’s working nature via undertaking Genius tax software. As per the Chartered Accountants (CA), company secretaries, and tax professionals, its interface has been made.

Comprehensive Reporting Analysis

Detailed reports are generated by Genius that deliver important insights into a client’s financial health, authorizing CAs and CSs to propose better financial advice.

Automatic Tax Calculations

It eradicates manual calculations of taxes for income, capital gains, and other heads, ensuring accuracy and saving valuable time.

Seamless Import and Export Data

From other accounting software CA and CS professionals can import data with ease, reducing manual data entry and lowering errors.

Such features lessen the administrative load on CAs and CSs, freeing up their time to concentrate on-

- Client Talk and Strategic Planning- By automating routine chores, the professionals could devote more time to in-depth consultations with clients, helping them make reported financial decisions.

- Risk Management and Compliance- Genius assures compliance with the updated tax regulations, authorizing CAs and CSs to recommend clients effectively on risk management strategies.

- Enhanced Client Service- The professionals with the surged efficiency could furnish clients with quicker turnaround times and a more personalized service experience.

Powerful Features of Genius Tax Software for CA and CS

Genius proceeds beyond basic automation by proposing features particularly targeted at the needs of CAs and CSs:

- Plan Management: The software assists in handling appointments with clients, ensuring effective time organization, and rectifying client communication.

- Collaboration Tools: The software promotes collaboration between CAs and CSs within a firm, facilitating the knowledge sharing and efficient implementation of client projects.

- Record Management: Genius authorizes for secure storage and easy retrieval of client documents, streamlining efficient record-keeping and audit preparation.

- Customization Prospects: The same authorizes user-defined settings and preferences, enabling CAs and CSs to tailor the software to their precise workflows and client requirements.

Improved Accuracy and Reduces Errors

The errors emerge from the manual data entry and difficult calculations. Genius lessens the same risk by automating such procedures and undergoing computations with built-in formulas based on the updated tax statutes. It decrypts to-

- Lowered Tax Penalties Risk: Correct tax filing ensures compliance and lessens the risk of penalties and interest charges for clients.

- Improved Client Trust: CAs and CSs propose to the client peace of mind with the knowledge that their tax and accounting processes are managed with precision.

- Advanced Professional Importance: Through the consistent furnishing of timely and accurate services, CAs and CSs could develop stringent relationships with clients and make their reputations as reliable advisors.

Authorizing Evolution and Scalability

Genius software optimizes individual workflows and authorizes CAs and CSs to handle larger client portfolios and grow their practices. By facilitating processes and decreasing time spent on routine tasks, professionals can:

- Bring More Clients: CAs and CSs with the surged efficiency can cater to a distinct range of clients, growing their business reach and revenue potential.

- Attract and Keep Top Talent: An approach driven through technology sets a firm as modern and efficient, making it more appealing to qualified CAs and CSs pursuing rewarding career prospects.

- Invest in Value-Added Services: The saved time via automation authorizes the professionals to concentrate on developing specialized skills and proposing high-value services like financial planning and business consulting.

Why Do Tax Professionals Proceed with Genius Tax Sofware?

In the current era of the dynamic field of tax preparation, the requirement for both efficiency and precision cannot be ignored. Tax professionals are facing issues like managing tight deadlines, intricate calculations, and the diverse needs of their clients. In such circumstances, Genius Tax Return Filing Software by SAG Infotech arrives. It is a robust tool that facilitates workflows and empowers Chartered Accountants (CAs), Company Secretaries (CSs), and tax specialists to deliver outstanding and reliable service to their clients.

Advanced automation features have been proposed by Genius software that extends beyond basic things. The same facilitates difficult computations, ensuring accurate results, etc. The software facilitates seamless e-filing, eradicating the necessity to download and upload forms, and fostering data import via other platforms to reduce manual entry and decrease the risk of errors.

Besides, built-in validation reviews serve as a safety net, recognizing inconsistencies before they evolve into expensive mistakes. It improves accuracy and encourages client confidence, ensuring that their tax returns are being managed with accuracy. Also within your practice, the same encourages collaboration by permitting team members to access and work on client data simultaneously, fostering knowledge sharing and facilitating efficient project completion.