Create a Chartered Accountant Website As Per ICAI Guidelines

Here, we are providing some general guidelines for the CA website of the Institute, as recommended by the Institute of Charte...

Here, we are providing some general guidelines for the CA website of the Institute, as recommended by the Institute of Charte...

The CA foundation course 2026 examination, administered by the Institute of Chartered Accountants of India (ICAI), serves as...

An Income Tax Return (ITR) is a form that is used to submit the information of your income and the relevant tax to the Income...

Tax Deducted at Source (TDS) at a specified rate and remitted to the government. On the other hand, for Tax Collection at Sou...

Selecting the right website template is a crucial step in building your online presence, particularly as a tax consultant loo...

Professional Chartered Accountants play a vital and comprehensive role in managing some of the most important activities ther...

The hosting of the Multipurpose Empanelment Form (MEF) for 2025-26 has been announced by the Institute of Chartered Accountan...

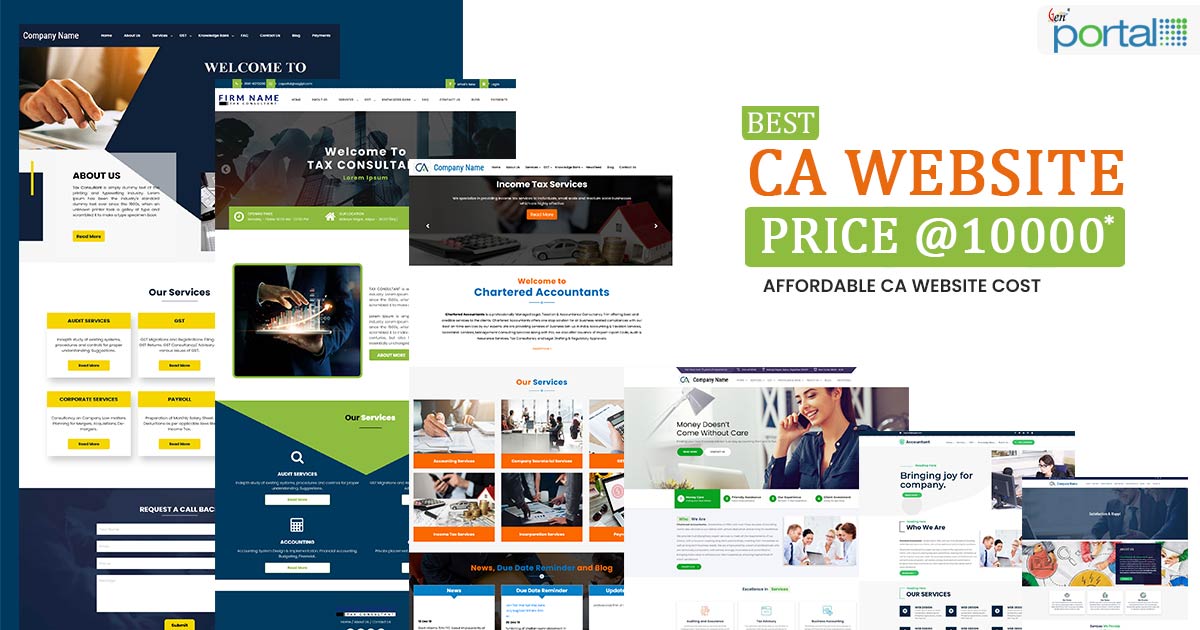

CA Portal brings the best chartered accountant website cost packages to Indian tax professionals and charter...

For businesses to build an online presence, including engaging with the target audience, making a website in the present era...

Our Team Members are Ready to Help You.