How To Become CA in India: Eligibility, Course & Career Guide

The Chartered Accountancy profession in India boasts a lengthy history, originating in 1949 with the establishment of the Ins...

The Chartered Accountancy profession in India boasts a lengthy history, originating in 1949 with the establishment of the Ins...

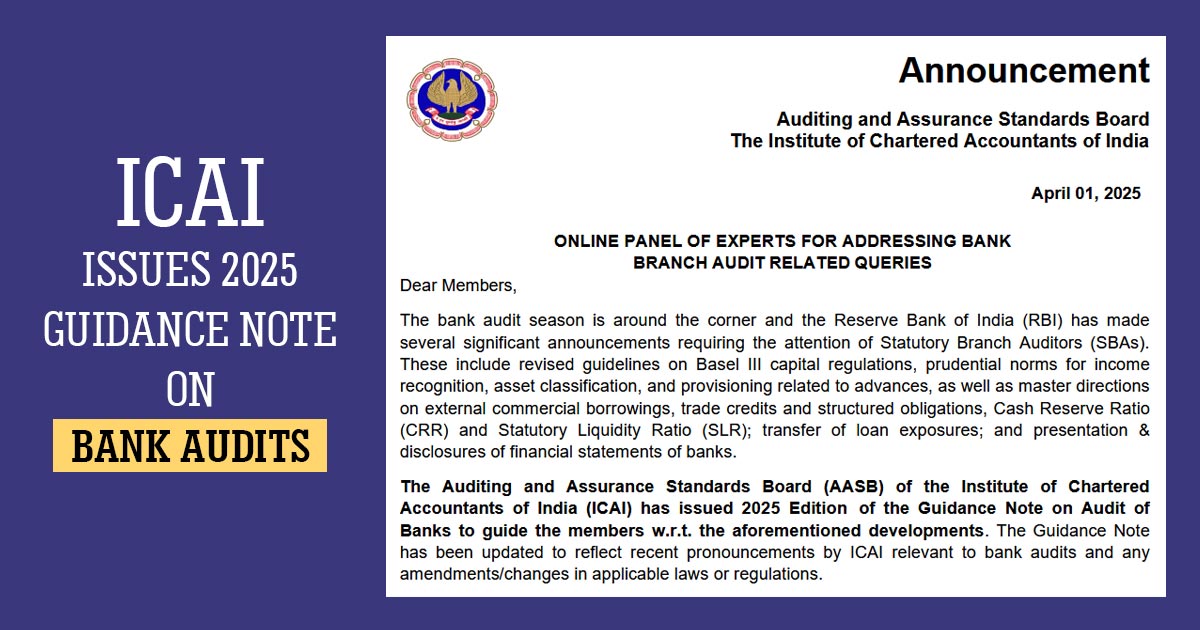

The Auditing and Assurance Standards Board (AASB) of the Institute of Chartered Accountants of India (ICAI), with the bank au...

The Institute of Chartered Accountants of India (ICAI) has published the 2025 Edition of the Exposure Draft for its Guidance...

A Company Secretary (CS) is a vital managerial role within a company, responsible for handling compliance and legal matters....

Given birth by the Parliament of India, the Institute of Chartered Accountants of India (ICAI) is a governme...

Chartered Accountants (CAs) in the current fast-paced business world play a significant role that proceeds more than just mai...

A chartered accountant is undoubtedly one of the most renowned professions domestically and outside India. CA is the preferre...

In every industry, it is important to have a professional website since the world is running digitally. Just think that you a...

International Women’s Day (IWD) 2025 acknowledges women's social, economic, cultural, and political accomplishments. To end...

Our Team Members are Ready to Help You.