5 Tips and Tricks to Bring the Best Accounting Website Templates

In the contemporary, high-speed world of business, the management of finances and keeping abreast of the latest accounting me...

In the contemporary, high-speed world of business, the management of finances and keeping abreast of the latest accounting me...

All across the world Chartered Accountancy (CA) qualification is highly respected especially for those who h...

The processing of a payroll is an important task for every business, but it takes so much time. It is important to ensure pre...

For submitting the observations for the exam scheduled for June 2024 of Chartered Accountancy, CA students are being invited...

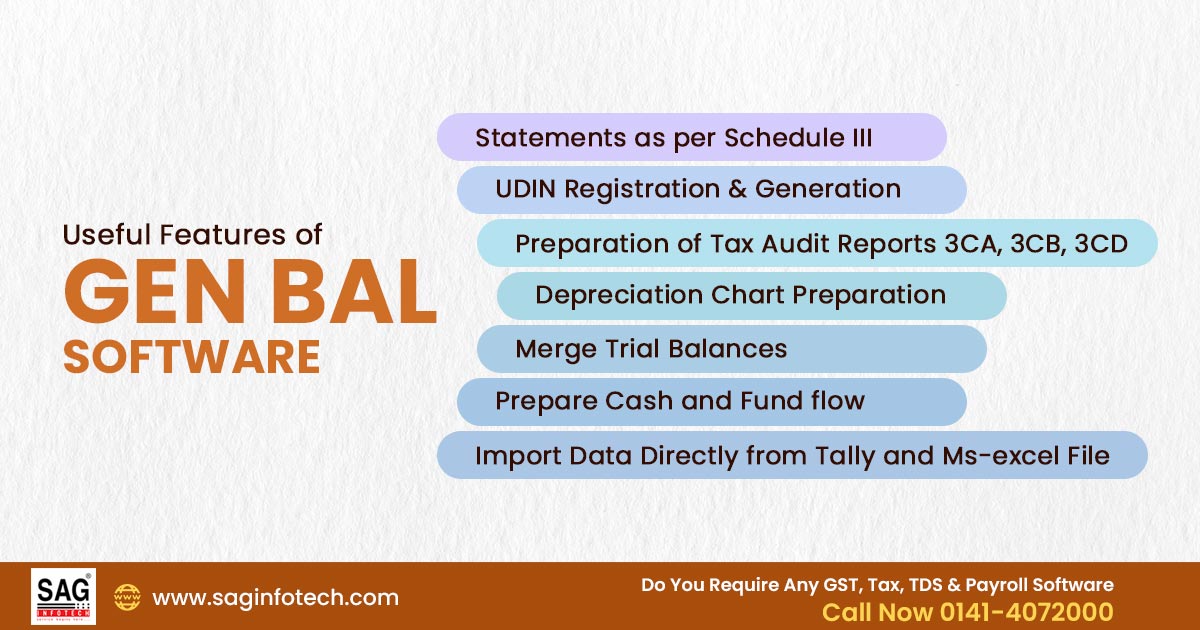

In this guide, you shall learn about the proper use of Gen Bal software and produce High-quality balance sheets. We shall dis...

The Power of the Internet and the Importance of Owning (chartered accountant) CA website purchases are unbeatable today....

If you're considering starting your accounting practice, you're envisioning creating a lasting impact. The appeal lies in the...

The Benefit of Blogging for accountants is that it enhances visibility. By consistently publishing relevant, informative cont...

Not getting success in the Chartered Accountancy (CA) exams can be a disheartening experience for aspiring professionals. The...

Our Team Members are Ready to Help You.