To follow with GST requirements, all businesses under the GST regime are required to file GST returns. One of the essential forms is GSTR 1. This form is crucial because the information filed under GSTR 1 serves as the basis for auto-populating all other forms. GSTR 1 is a monthly or quarterly return that provides a summary of all sales (outward supplies) made by a taxpayer. It is important to ensure that a valid GSTIN is provided when entering sales invoice details. The GSTR 1 due date is to be submitted monthly by every registered dealer, either monthly or quarterly, as per their yearly turnover.

The due date for filing Form GSTR 1 for a provided tax period is the 11th day of the next month in case of taxpayers filing it monthly, and the 13th day of the month succeeding the finish of every quarter in case of taxpayers filing quarterly, or such other dates as might be extended by the Government via a notification.

Below, we provide a comprehensive overview of the GSTR 1 due dates for both quarterly and monthly returns for taxpayers registered under GST, including extended deadlines, E-way bill penalties, and a complete guide for regular taxpayers.

What is the Importance of GSTR 1?

As per the law, every registered business is required to file GST returns for tax payments. A GST return is a document that comprises the information for your income/sales and expenses/and purchases. It is a document that every GST-registered individual needs to file with the taxation authorities. GSTR 1 outlines all sales (outward supplies) of an assessee. Be sure to enter a valid GSTIN while filling in the sales invoice details. GSTR 1 from is must be submitted by every registered dealer, either on a monthly or quarterly basis, depending on their annual turnover. From the registered assesses, this form requires them to furnish complete data for all their outward supplies and sales transactions.

GSTR 1 is a return statement that regular dealers use to report all outward supplies made during a month or a quarter. In simple terms, GSTR 1 captures details of sales and other outward supplies. While GSTR 3B is a monthly self-assessed return, GSTR 1 must be filed with details of outward supplies that support the liability declared in GSTR 3B.

Tax authorities use the same to compute your tax liability and include the following:

- Purchases

- Sales

- Output GST (for sales)

- Input Tax Credit (GST paid on purchases)

GST returns must be filed as per tax periods, monthly GSTR 1 or quarterly GSTR 1. In total, there are 13 GST return forms. But you are just required to file GST returns applicable to your business.

Fill The Form for Free DEMO : Make a CA Firm Website

GSTR-1 due date for quarterly return or monthly return that must be furnished through every enrolled GST assessee, excluding some specific cases as provided in the subsequent sections. It includes information on all the outward supplies, i.e. sales. The return consists of the sum of 13 sections as mentioned below:

The return has a total of 13 sections, listed as follows:

- Tables 1, 2 & 3: GSTIN, legal and trade names, and aggregate turnover in the previous year

- Table 4: Taxable outward supplies to registered persons (including UIN-holders), excluding zero-rated supplies and deemed exports

- Table 5: Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs 2.5 lakh

- Table 6: Zero-rated supplies as well as deemed exports

- Table 7: Taxable supplies to unregistered persons other than the supplies covered in Table 5 (net of debit notes and credit notes)

- Table 8: Outward supplies that are nil rated, exempted and non-GST in nature

- Table 9: Amendments to outward supplies that are taxable and reported in tables 4,5, & 6 of the earlier tax periods’ GSTR-1 return (including debit notes, credit notes, and refund vouchers issued during the current period)

- Table 10: Debit note and credit note issued to an unregistered person

- Table 11: Details of advances received or adjusted in the current tax period or amendments of the information reported in the earlier tax period.

- Table 12: Outward supplies summary based on HSN codes

- Table 13: Documents issued during the period.

- Table 14: For suppliers – Reporting ECO operators’ GSTIN-wise sales through e-commerce operators on which e-commerce operators are liable to collect TCS u/s 52 or liable to pay tax u/s 9(5) of the CGST Act

- Table 14A: For suppliers – Amendments to Table 14

- Table 15: For e-commerce operators – Reporting both B2B and B2C, suppliers’ GSTIN-wise sales through e-commerce operators on which e-commerce operator must deposit TCS u/s 9(5) of the CGST Act

- Table 15A: For e-commerce operators –

- Table 15A I – Amendments to Table 15 for sales to GST-registered persons (B2B)

- Table 15A II – Amendments to Table 15 for sales to unregistered persons (B2C)

Who is Required to File GSTR 1 Return Form?

GSTR 1 is mandated to be filed by every registered dealer. It is required regardless of the transactions and sales for a specific month. Regardless of whether there are any sales or transactions, you must still submit GSTR 1 as a registered dealer.

Below are the mentioned individuals/entities who are not required to file GSTR 1:

- An input service distributor (ISD): You are counted under the category of an input service distributor under GST if your business obtains the invoices for the services used via your branches.

- Composition dealer: If you have registered your business under the GST composition scheme, then you are a composition dealer. The companies from 1st April 2019 holding an annual turnover of up to Rs 1.5 crores can choose the composition scheme.

- A supplier of online information, database access, or retrieval services.

- Non-resident taxable people: If you import goods and services from outside India or are in charge of handling a business for a non-resident Indian (NRI), then you are a non-taxable resident individual.

- An assessee is mandated to collect tax at the source (TCS), or a taxpayer is liable for deducting tax at the source (TDS).

When is the Due Date for GSTR 1?

Upon the grounds of the GSTR 1 due date extension notification and your turnover, the last dates for GSTR-1 are relied on. Businesses with sales of up to Rs 5 crore can furnish the quarterly return under the QRMP policy, which is due on the 13th month after the related quarter.

The GSTR 1 form filing is a mandatory return form under GST. Registered taxpayers with an annual turnover exceeding ₹ 1.5 crore must file the GSTR 1 return on the 11th of the next month. Taxpayers must furnish complete details of their outward supplies in the GSTR 1 form.

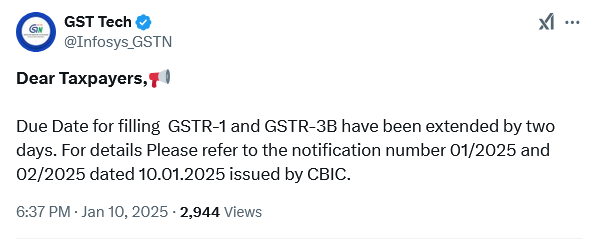

Extended GSTR 1 Due Date in December 2024 notification

We have extended the due date for filling out GSTR 1 and GSTR 3B by two days. See CBIC notifications 01/2025 and 02/2025 dated 10.01.2025 for more information.

GSTR 1 Due Date July To September 2026 (Turnover up to INR 1.5 Crore)

| Period (Quarterly) | Due Dates | January To March 2026 | 13th April 2026 | October To December 2025 | 13th January 2026 | July To September 2026 | 13th October 2026 | April To June 2025 | 13th July 2025 |

|---|---|

| July To September 2025 | 13th October 2025 |

GSTR 1 Due Dates Turnover More Than INR 1.5 Crore

| Period (Monthly) | Due Dates |

|---|---|

| January 2025 | 11th February 2026 |

| December 2025 | 11th January 2026 |

| November 2025 | 11th December 2025 |

| October 2025 | 11th November 2025 |

| September 2025 | 11th October 2025 |

| August 2025 | 11th September 2025 |

| July 2025 | 11th August 2025 |

| June 2025 | 11th July 2025 |

| May 2025 | 11th June 2025 |

| April 2025 | 11th May 2025 |

| March 2025 | 11th April 2025 |

| February 2025 | 11th March 2025 |

| January 2025 | 11th February 2025 |

| December 2024 | 13th January 2025 | Extended Due Date |

| November 2024 | 11th December 2024 |

| October 2024 | 11th November 2024 |

| September 2024 | 11th October 2024 |

IFF Quarterly Filing (QRMP Scheme) Due Date of GSTR 1

| Period (Monthly) | Last Dates |

|---|---|

| January 2026 | 13th February 2026 |

| December 2025 | 13th January 2026 |

| November 2025 | 13th December 2025 |

| October 2025 | 13th November 2025 |

| September 2025 | 13th October 2025 |

| August 2025 | 13th September 2025 |

| July 2025 | 13th August 2025 |

| June 2025 | 13th July 2025 | May 2025 | 13th June 2025 |

| April 2025 | 13th May 2025 |

| March 2025 | 13th April 2025 |

| February 2025 | 13th March 2025 |

| January 2025 | 13th February 2025 |

| December 2024 | 15th January 2025 | Extended |

| November 2024 | 13th December 2024 |

Do You Need Any Documents to File Your GSTR 1?

You will be required to have the following documents and information readily available to file GSTR 1.

- A valid and genuine Goods and Services Tax Identification Number (GSTIN).

- The user ID and password are required to sign into the portal.

- A digital signature certificate, unless you can e-sign the form, as per your categorization as a supplier.

- Aadhaar number if you are e-signing the form.

- Access to the mentioned mobile number on your Aadhaar card.

Read Also: Complete Overview of GSTR 3B Due Date Return Filing

Importance of Timely GSTR 1 Filing

Various benefits have been provided to businesses when filing the GSTR-1 within the stipulated timeframe. Check out the GSTR 1 Detailed Format

- Avoid Penalties– There shall be no penalties if the timely filing has a function that could be substantial and add to the cost of your compliance.

- Input Tax Credit– Only based on the timely filed GSTR-1 can your suppliers claim the ITC. Delays in filing might be directed to ITC flow issues that affect your working capital.

- Reconciliation – Timely filing permits for the simpler data reconciliation between your GSTR-1 and your suppliers’ GSTR-2A, assuring precision and compliance.

- Good Business Reputation– A regular track record of timely GST filings enhances the credibility and reputation of your company.

How To Do GSTR 1 Import Invoices From the E-way Bill Site?

Import invoice information through the e-way bill portal to make GSTR-1 every month or quarter, as per the case. The blog guides you to learn in detail the options available on the GST portal login to import sales invoice information through the e-way bill site to prepare GSTR-1.

On the GST portal, the feature is needed to provide relief for the assessee who deals with goods and generates e-way bills for their transportation. These assessments could make use of the option to integrate the e-way bill management portal on ewaybill.gst.gov.in and the GST return filing portal on gst.gov.in

Data Import Option for GSTR 1 From E-way Bills

The assessee again needed to upload the invoices on the e-way bill site and proceed to the GST portal when filing GSTR-1. Assessments must proceed through the aggravation of importing that data twice onto distinct portals. An option is added on the GSTR 1 filing dashboard, “Import EWB data” for three tiles, to prevent the same. The same shall diminish the errors that have been engaged in the input of data for the assessments and support the tax heads in tracking tax evasion.

Late Fees and Penalty for GSTR 1 Form

Late filing fees and possible penalties may apply if you submit a GSTR 1 form after the due date. According to the GST law, the late fee for not submitting GSTR-1 is Rs 200 per day for delayed filing (Rs 100 as per the CGST Act and Rs 100 as per the SGST Act). This late fee is calculated from the day following the last filing date.

However, following notifications issued up to February 2021, late fees have been reduced to Rs 50 per day and Rs 20 per day for nil returns. It’s important to note that, currently, the GST portal does not require late fee payment for GSTR 1 as part of the payment challan in PMT-06 at the time of filing GSTR-3B.

As per CGST notification 20/2021 dated June 1, 2021, the maximum late fee is applicable from June 2021 onward.

Individuals with no outward supplies in the tax period will not be subject to the maximum late fee of Rs 500 (Rs 250 per Act). Conversely, individuals with a total turnover of Rs 1.5 crores in the previous fiscal year, excluding nil return filers, are subject to a maximum late fee of Rs 2000 (Rs 1,000 per Act).

Individuals with an average annual turnover exceeding Rs 1.5 crores but not exceeding Rs 5 crores in the previous fiscal year, excluding nil filers, can be charged a maximum late fee of Rs 5000 (Rs 2500 per Act). There is no change in the maximum late fee for assesses whose total turnover exceeds Rs 5 crores, and it remains at Rs 10,000.

It’s important to note that tax authorities may issue notices for late fee payments during the assessment of returns.

Latest Updates in GSTR 1 Form

- The GST Network (GSTN) has announced an Advisory to file pending returns before the expiry of three years. GST returns can only be filed within three years from their due dates. Read Official copy of the Advisory

- 53rd GST Council Meeting Updates:

- “The threshold for reporting of B2C inter-State supplies invoice-wise in Table 5 of FORM GSTR-1 was recommended to be reduced from Rs 2.5 Lakh to Rs 1 Lakh.”

- “The GST Council has suggested an optional Form GSTR-1A for taxpayers. read more.” Read more

- “Due to many technical issues, the GSTN department has extended the GSTR 1 due date to 12th April for March 2024.” View more

- “GSTN has enabled new features for GSTR-1 taxpayers to fetch the HSN summary from GST e-invoices in Table 12. However, in cases where the HSN code is not available, it needs to be added manually”. View more

Most FAQ About GSTR 1 Retrun Filing Form

Q.1 – Is it necessary to submit GSTR-1 even if there are no sales in a particular month?

Ans: Yes, it is compulsory to file GSTR-1 even if there have been no sales during a specific month or quarter. In such cases, you need to submit a Nil GSTR-1.

Q.2 – Can invoices be uploaded during the return filing process only?

Ans: Invoices can be uploaded at any time. It is advisable to upload invoices on a regular basis throughout the month to avoid a bulk upload during the return filing period, as it can be time-consuming.

Q.3 – Can I modify an uploaded bill or invoice on the GST portal?

Ans. After uploading invoices, you can make rectifications multiple times. There are no limitations on modifying invoices once they have been uploaded. However, changes can only be made before submitting a return. Once a return is submitted, the numbers will be locked.

Q.4 – Can GSTR-1 be submitted after the due date?

Ans: Yes, you can file GSTR-1 even after the due date. However, a late fee based on the number of delayed days will be applicable.

Q.5 – How GSTR 1 and GSTR-3B are different?

Ans: GSTR-1 requires reporting of all sales details, whereas GSTR-3B involves reporting summarized figures of sales, input tax credit (ITC) claimed, and net tax payable.

Q.6 – Can GSTR-1 be filed after filing GSTR-3B?

Ans: No, GSTR-1 needs to be filed before filing the GSTR-3B return, starting from January 1, 2022.

Q.7 Should I file GSTR-1 because I have opted for the composition scheme?

Ans: If you have opted for the composition scheme, you are not required to file GSTR-1. Instead, you need to use Form CMP-08 to make tax payments on a quarterly basis.

Q.8 – Is it necessary to make a GST payment after filing GSTR-1?

Ans: GSTR-1 is a return where sales details are reported to the government. Therefore, there is no need to make a tax payment after filing this return. However, the tax due must be paid during the submission of GSTR-3B.

Q.9 – When can I choose the quarterly return option for filing Form GSTR-1?

Ans:You have the option to choose quarterly filing of Form GSTR-1 in the following situations:

- If your turnover during the previous financial year was up to Rs. 5 Crore, or

- If you are newly registered in the current financial year and expect your aggregate turnover to be up to Rs. 5 Crores.

Note: If you choose the quarterly return option, both Form GSTR-1 and Form GSTR-3B are required to be submitted quarterly.

Q.10 – I have been filing GSTR-1 quarterly, and my annual sales are below Rs. 1.5 crore. What happens if I choose the QRMP scheme?

Ans: If you opt for the QRMP (Quarterly Return Monthly Payment) scheme, you need to continue filing GSTR-1 on a quarterly basis. Additionally, GSTR-3B must be filed quarterly, with monthly tax payments. However, it is suggested to find more information on the QRMP scheme.

Q.11 – How can I submit my invoices in accordance with the QRMP scheme?

Ans: To upload your invoices for the first two months of the quarter, you can utilize the Invoice Furnishing Facility (IFF). For the invoices of the last month, you can include them in the quarterly GSTR-1. For more detailed information about IFF, you can click here.

Q.12 – Is it possible to make changes to already filed details in GSTR-1? If so, what is the timeframe for making amendments?

Ans: TAbsolutely, you can make modifications to a previously filed GSTR-1 for a specific tax period by declaring the corrected information in the return.

For instance, let’s consider the case of Mr. X from Kerala, who sold goods worth Rs. 1,00,000 to Mr. Y from Karnataka on 30th December 2022. Mr. X initially reported this transaction in the GSTR-1 of December 2022. However, upon realizing that there was an error in the invoice date, he can create an amended invoice with the correct date, which is 16th December 2022. This amended invoice can be included in the GSTR-1 of January 2023.

Q.13 – I am having difficulty viewing the invoices I have uploaded. What steps should I take?

Ans: To view the invoices you have uploaded, scroll down to the bottom of the Form GSTR-1 – Details of outward supplies of goods or services page and click the “GENERATE GSTR1 SUMMARY” button. This will incorporate the auto-drafted details awaiting action from recipients, and your added invoices will start appearing in the relevant section of Form GSTR-1.

If you wish to view the summary immediately after adding the invoices, you can generate the summary by clicking the “GENERATE GSTR1 SUMMARY” button. However, you have to keep in mind that the summary can only be generated at intervals of 10 minutes. If you attempt to generate a summary again within 10 minutes of the previous one, you may encounter an error message at the top of the page.

The summary is automatically generated by the GST Portal approximately every 30 minutes. Additionally, you can check if an error file has been generated upon uploading the JSON file created from the Offline Tool. If an error file exists, through the offline tool, you can download the error report and make corrections to any issues.

Q.14 – What should be the revised date mentioned in the amended invoice?

Ans:The revised date in an amended invoice should not be later than the last date of the original invoice’s tax period.

For instance, if the original invoice is dated 12th December 2022 and is being amended in January 2023, the revised invoice date cannot be later than 31st December 2022.

Q.15 – Which amendments are not permissible or not allowed?

Ans: Amendments at the invoice level are not allowed for the following details:

- Customer GSTIN

- Changing a tax invoice to a bill of supply

- The below-mentioned details cannot be amended with respect to Export Invoices:

- Shipping Bill Date/Bill of Export Date

- Type of Export – With/Without payment

- The below details related to Credit Debit Notes cannot be amended:

- Receiver/Customer GSTIN. However, you can amend and link any other invoice for the same GSTIN.

- Place of Supply

- Reverse charge applicable reasons: these restrictions are that the above-mentioned details are based on the original invoice to which they are linked, and they must match the details of the linked invoice.

- If the recipient of the goods has performed any actions regarding the invoices, such as accepting or modifying them, and the supplier accepts those modifications in GSTR-1A, the supplier will not be allowed to make amendments to those invoices. This is because those invoices will automatically be reflected in the supplier’s GSTR-1 in the month of acceptance, in accordance with the relevant amendments table.

- Amendments at a summary level are not permissible for the following details:

- Nil Rated

- HSN summary of Outward supplies

- Adding a new place of supply

- Note: However, you can replace the existing place of supply with another place of supply, but with certain limitations. Please refer to the examples mentioned below for further clarification.

July 7, 2020

what are due dates of GSTR-1 & GSTR-3B for the month of June-2020 for LLP firm having turnover less than 1.5cr.

July 16, 2020

Due date for GSTR-1 for the month of June is 5th August 2020

Due date for GSTR-3B for the month of June is 23rd or 25th July 2020 as per Group A and Group B respectively.

June 29, 2020

24th June 2020

March 21, 2020

I have filed GSTR 3B on December 2018. Then I have not file any return I do not have any business till date… I purchased goods over 3Lac with 18% GST (9+9) but it was not sold. I have to return the stock. I need to clears all my returns by 31st March’2020. How much penalty I have to pay for Nil Return. and clear all my dues.

March 26, 2020

For Nil Return Rs 20 Per day and for other than Nil Return Rs 50 Per day

January 31, 2020

Sir,

iwant to know the late fees of GSTR 1for Q2 (SEP19-DEC19)

February 3, 2020

If you have nil return then late fees would be Rs 20/day otherwise Rs 50/day

January 22, 2020

sir mera turn over 30lakh lekin maine gstr1 me quterly select nahi kiya or humne quterly gstr1 submit kar diya hai to sir ab kaya hoga plz help me

January 23, 2020

As you didn’t select quarterly return option so you have to file GSTR 1 on monthly basis.

January 21, 2020

Every taxpayer has to file GSTR-1 even if he has no business activity during the period, i.e. no sales in a month/quarter. So, you have to file a Nil GSTR-1.

January 18, 2020

gst ri april month april 2019 ki fill ni h

late fee kaise calculale hogi

January 20, 2020

If you have filed your GSTR-1 for the month of April 2019 till 17th January 2020 then there will be no late fees but

If you have not filed your return till 17th January then late fees will be applicable Rs 20/day(If NIL Return) and Rs 50/day(If tax liability) is there.

January 10, 2020

IF GSTR-1 FOR THE PERIOD JULY 2017 TO SEP 2017 FILED AFTER 10TH JAN 2019 THEN WHAT WILL BE THE LATE FEE. FULL AMOUNT FROM JULY 2017 OR 50/20 RS PER DAY AFTER 10 JAN 2019?

January 13, 2020

Late Fee for CMP-08 will be Rs 50/day, i.e., Rs 25/day CSGT and Rs 25/day IGST in case of any tax liability. On the other hand, if there is a NIL tax liability, then the late fee will get reduced to Rs 20/day, i.e., Rs 10/day CSGT and Rs 10/day IGST subject to maximum of Rs 5000 starting from the due date to the actual date of return filing by the taxpayer.

January 6, 2020

IS ANY INDICATION OF EXTENSION OF GST R 1 SUBMISSION DATE ? THE LAST DATE IS 10/01/2019

January 7, 2020

Please contact GST Portal

January 4, 2020

please guide me gstr1 details

January 6, 2020

Easy guide to GSTR 1 with complete online return filing procedure to view

https://blog.saginfotech.com/gstr-1-online-return-filing

January 2, 2020

GSTR1 for december 2019 filed after 11 january 2020, then penalty will levy or not??

January 7, 2020

Rs 25 per day for nil return and Rs 50 per day for taxable supply.

September 20, 2019

Dear Sir

If GSTR 1 for the month of Aug 2019 is submitted on 11.09.2019

and but forgot to file return.Later on 19th september we found and then we filed.. How much the fine we have to pay

September 20, 2019

Late fee in case of NIL returns is Rs. 20/- per day. in any other case, it is Rs. 50 per day.

July 27, 2019

DATE CONFIRM GSTR 1 FOR THE APRIL – JUNE 2019 COMPOSITION SCHEME IS EXTENDED ?

July 29, 2019

Sir, the composition scheme of filing has been extended up to 31 August 2019. GSTR 1 April to June 2019 no information related extended notification in this CBIC.

June 20, 2019

what is the due dates of GSTR 1 and GSTR 3B if option opted return filled on Quarterly basis. means Turnover is below 1.5 so option opted quarterly basis.

Due Dates of Both Returns ????

June 20, 2019

For the turnover filing of INR 1.5 Crore, the last date for filing GSTR 1 for the April – June 2019 is 31 July 2019. The 20th June 2019 is the last due date for Filing GSTR 3B Return for june 2019.

June 10, 2019

Dear Team,

Please confirm that the due date for monthly GSTR1 is extended upto 13th June?

June 12, 2019

The GST Calendar of Return Filing Due Dates for GSTR1 June 2019 no update to extended by CBIC.

December 26, 2018

Yes, you can file GSTR 3B return without filing GSTR 1.

December 22, 2018

Last date for GSTR 1 December 2018?

December 24, 2018

Last due date for GSTR 1 December 2018 (Turnover More than 1.5 Crore) is 11th January 2019.

December 11, 2018

November month GSTR-1 If not filed means penalty will be raised or not..??

December 12, 2018

If you did not file your GSTR 1 return for previous months then your penalty will be raised.

December 9, 2018

Sir, can we modify the purchase details in GSTR-2 of July 2017 to October 2018.

December 10, 2018

No, You cannot modify the purchase details in GSTR-2 of July 2017 to October 2018.

November 26, 2018

1. If I want to change from quarterly GSTR-1 to monthly is it possible.

2. Can I get credit even if my client file return in jan’19 for the period July’17.

November 27, 2018

In mid of month, you cannot opt from quarterly to monthly. It is possible only in starting of the financial year or till you haven’t filed any single return for that year.

Yes, you can claim.

November 21, 2018

There are no fees to be paid on late filing of GSTR-1.

August 4, 2018

Hi,

Could you please quote me the notification/circular/order issued by CBIC based on which you mentioned that the due date of FORM GSTR-3B for July, 2018 to be 20 August, 2018? Thanks in advance.

August 9, 2018

Check here the latest circular and GSTR 3b due dates issued by the commissioner of GST in order to revise due date of GSTR 3B for July on 20th August 2018

July 7, 2018

I need to update the whole returns in GST indirect taxation with due date, interest,penalty and new provision which will be updated by Indian indirect taxation systems.

July 10, 2018

Please clarify your question as to whether you want to file returns or pay taxes.