Tax Deducted at Source (TDS) at a specified rate and remitted to the government. On the other hand, for Tax Collection at Source (TCS), the receiver of the payment is liable to collect tax from the payer and then submit it to the government. For more information, you can see the TDS and TCS return filing due date with the last dates for filing for FY 2025-26 (AY 2026-27). E-filing returns of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are filed every quarter, and the quarterly statements are accepted regarding provisions of the Income Tax Department. Be sure to check the eligibility requirements, penalty details, and filing process for this tax return.

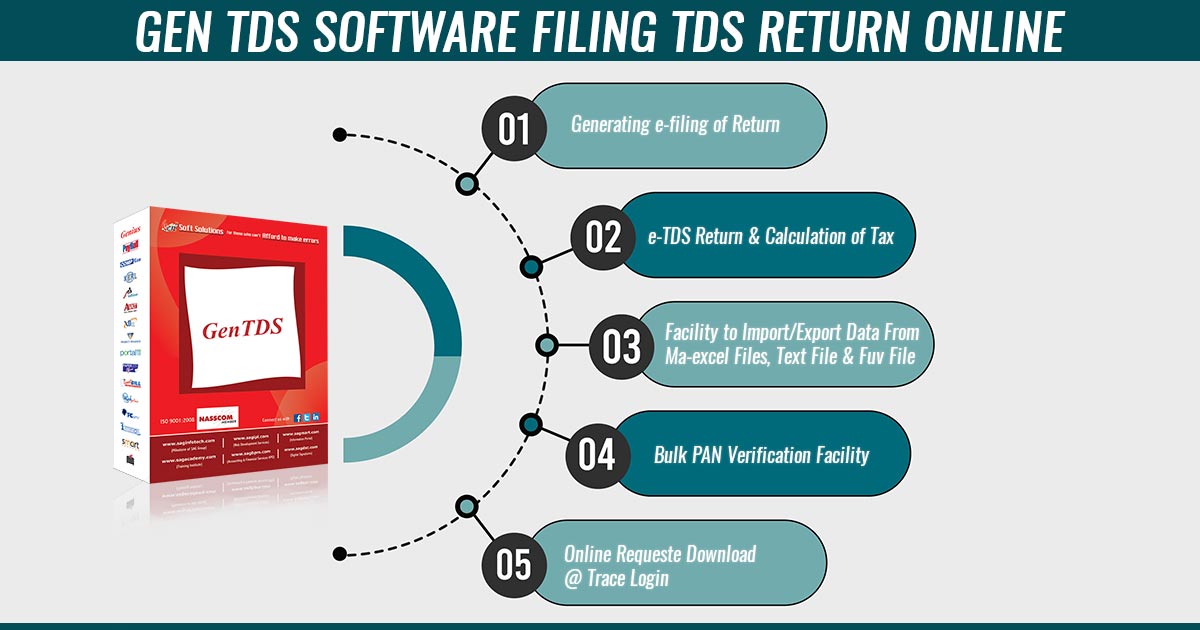

The Income Tax Department of India modified file formats for TDS and TCS statements. Deductors/collectors need to be ready to prepare e-TDS & TCS statements according to the file formats with the help of NSDL e-Gov and return the prepared statement through third-party software and in-house software for rendering to any TIN-FCs.

TDS and TCS statements are required to be filed every quarter. However, according to the income tax department, approval of TDS/TCS statements before the FY 2007-08 is not allowed at the TIN. The TDS return filing due date must be accompanied by the rate of tax and other statutory compliance by the taxpayers. Users need to pass the E-TDS and TCS return file produced utilising RPU via the File Validation Utility (FVU) to make sure the format of the file is correct.

Detailed Quarterly Tax Deduction/Collection Statements

Forms to be filled out for quarterly TDS/TCS statements relating to taxes deducted/collected are as follows:

| Details | Form No. |

| Tax deduction from salary under Section 192 | 24Q |

| Tax collection when deductees are non-resident (not being a company), foreign companies and persons who are resident but not ordinary residents | 27Q |

| Tax deduction under Section 194-IA | 26QB |

| Tax deduction under Section 194-IB | 26QC |

| Tax deduction under Section 194M | 26QD |

| Tax deduction in any other case | 26Q |

| Tax Collection | 27EQ |

Implementation of a Rationalization Plan for TDS/TCS

The rationalisation of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) has been proposed by the Union Budget 2025 to facilitate the compliance challenges for the taxpayers, particularly for the middle-income earners. The government has raised the threshold limits in distinct TDS sections, which has the motive to ease the process of tax. The proposed amendments are stated as follows:

| Section | Present | Proposed |

| 193 – Interest on securities | NIL | 10,000 |

| 194A – Interest other than Interest on securities | (i) 1,00,000/- for senior citizen (ii) 50,000/- in case of others when payer is a bank, cooperative society and post office (iii) 10,000/- in other cases | 194B – Winnings from lottery, crossword puzzle, Etc. & 194BB – Winnings from horse race |

| 194G – Income by way of commission, prize, etc., on lottery tickets | 5,000 | 10,000 |

| 194K – Income in respect of units of a mutual fund | 5,000 | 10,000 |

| (i) 1,00,000/- for senior citizen (ii) 50,000/- in case of others when the payer is a bank, cooperative society and post office (iii) 10,000/- in other cases | Aggregate of amounts exceeding 10,000/- during the financial year | 10,000/- in respect of a single transaction |

| 194D – Insurance commission | 15,000 | 20,000 |

| 194H – Commission or brokerage | 15,000 | 20,000 |

| 194-I – Rent | 2,40,000 (in a financial year) | 6,00,000 (in a financial year) |

| 194J – Fee for professional or technical services | 30,000 | 50,000 |

| 194LA – Income by way of enhanced compensation | 2,50,000 | 5,00,000 |

| 206C(1G) – Remittance under LRS and overseas tour program package | 7,00,000 | 10,00,000 |

Note:

- The Tax Collected at Source (TCS) will be eliminated on remittances made for educational objectives when these remittances are financed via loans from established financial institutions (Section 80E).

- W.e.f April 1, 2025, the tax collected at source (TCS) on the purchase of goods will be removed.

- The Higher TDS rate shall be applicable in cases where the taxpayers do not furnish the PAN.

Need to know about TDS (Tax Deducted at Source)

TDS is mentioned as Tax Deducted at Source. It is the tax amount that the government collects directly from the income of the receiver immediately after earning. At a certain percentage, the TDS is deducted. According to the IT Act, an individual or any company can deduct such tax at the source if the payment for any goods or services crosses a particular amount.

TDS rates and the thresholds for distinct sorts of goods and services have been decided by the government for the specific fiscal year.

The services comprise the following:

- Royalty

- Technical services

- Legal fees

- Consulting

- Rent, etc.

The individual or firm receiving the payment is said to be the deductee in the transaction where the TDS is applied. The individual or business deducting TDS from the payment is called a deductor.

For certain sorts of payments, see the TDS rates proposed

| Type of Payment | TDS Rate |

| Salaries | As per the tax slab |

| Rental charges greater than Rs. 50,000 per month for buildings, land, plant and machinery | 10% for land, 2% for plant and machinery |

| Prize money for a lottery, horse race, crossword puzzle, etc., is more than Rs 10,000 | 30% |

| Prize money for a lottery, horse race, crossword puzzle, etc., more than Rs 10,000 | 5% |

| Purchase of immovable property of more than Rs. 50,00,000 | 1% |

| Brokerage or commission from lottery ticket sales amounting to more than Rs 15,000 | 1% for individuals or HUF, 2% for Others |

For example, ABC Ltd. pays a rent of Rs 52,000 per month for a warehouse. which is above the threshold of Rs. 50000 per month for a warehouse.

Therefore, ABC Ltd. will deduct the TDS at the rate of 10%, amounting to Rs. 5200, and then pay Rs. 46800 as the monthly rental charges.

The warehouse’s owner will list Rs. 624000 gross income in his income tax return and claim a TDS of Rs. 62400, which has already been deducted, as a total tax liability credit, also known as a TDS credit.

In other words, TCS stands for Tax Collected at Source. According to Section 206C of the Income Tax Act, sellers impose TCS on their goods and collect it from buyers at the time of sale.

Certificates of Compliance with TDS

| Form | Issued For | Frequency | Due Date |

| Form 16 | Employer to the employees as proof of deduction of tax | Annual | June 15 every year |

| Form 16A | Purchase of property by the resident buyer from the resident seller of the property | Quarterly | 15th Aug. for April-June, 15th November for July-Sept., 15 Feb. for Oct.- Dec. and 15th June for Jan-March |

| Form 27D | Seller (collector of TCS) to the Buyer (collectee) on TCS | Quarterly | 15th Aug. for April-June, 15th November for July- Sept., 15th Feb. for Oct.- Dec. and 15th June for Jan-March |

| Form 16A | Buyer of virtual digital asset(VDA) from the resident seller of VDA | Quarterly | 30th July for April-June, 30th Oct. for July-Sept., 30th Jan. for Oct.-Dec. and the 30th May for Jan- March |

| Form 27D | Seller (collector of TCS) to the Buyer (collector) on TCS | Quarterly | 30th July for April-June, 30th Oct. for July-Sept., 30th Jan. for Oct.-Dec. and 30th May for Jan- March |

| Form 16B | Resident tenant to the resident Landlord on the payments of rent | Every Transaction | 15 days from the due date of filing of Form 26QB |

| Form 16C | Contractual services/professional services to resident contractors and professionals- Payments of Contract or Professional fee | every transaction | 15 days from the due date of filing of Form 26QC |

| Form 16D | Contractual services/professional services to resident contractors and professionals-Payments of Contract or Professional fee | every transaction | 15 days from the due date of filing of Form 26QD |

| Form 16E | Seller (collector of TCS) to the Buyer (collected) on TCS | every transaction | 15 days from the due date of filing of Form 26QE |

TDS 4th Quarter Due Date for FY 2025-26 (AY 2026-27)

| Quarter | Quarter Period | Last Date of Filing |

| 1st Quarter | 1st April to 30th June | 31st July 2025 |

| 2nd Quarter | 1st July to 30th September | 31st October 2025 |

| 3rd Quarter | 1st October to 31st December | 31st January 2026 |

| 4th Quarter | 1st January to 31st March | 31st May 2026 |

Note:

- As against the stress that has occurred continually described by income taxpayers in electronic filing of Income Tax Forms 15CA/15CB on the web portal www.incometax.gov.in, it’s determined by CBDT that taxpayers can present the above-mentioned forms in manual format to the approved dealers till August 15th, 2021 (Revised). Read more Press Release

Complete Website with New ICAI CA India Logo for ₹8000!

Introduction About TCS (Tax Collected at Source)

A tax collected at the source (TCS) is the tax collected by the seller from the buyer on sale, so that it can be deposited with the tax authorities. Section 206C of the Income Tax Act regulates the goods where the seller is mandated to collect tax from the buyers.

TCS rates for some commonly bought goods are:

| Good purchased | TCS rates |

| Tendu leaves | 5% |

| Alcohol | 1% |

| Timber wood from a forest on lease | 2.5% |

| Motor vehicles worth more than Rs.10 lakh | 1% |

| Toll plaza, quarry, mine and parking lot | 2% |

| Metals (including iron ore, lignite and coal) | 1% |

| Forest produce (excluding tendu leaves and timber) | 2.5% |

For instance, Mr Mishra purchases tendu leaves worth Rs. 60,000 from Mr Desai. But Mr Mishra will pay the following amount:

Rs.{60,000 + (5% of 60,000)} = Rs.63,000

Mr Desai will collect the extra Rs. 3,000, also known as TCS credit.

TCS 4th Quarter Due Date for FY 2025-26

Important tax deadlines are due on the TCS 4th Quarter January to March due date, FY 2025-26 (AY 2026-27).

| Quarter | Quarter Period | Last Date of Filing |

| 1st Quarter | 1st April to 30th June | 15th July 2025 |

| 2nd Quarter | 1st July to 30th September | 15th October 2025 |

| 3nd Quarter | 1st October to 31st December | 15th January 2026 |

| 4th Quarter | 1st January to 31st March | 15th May 2026 |

Note: Generate the TDS/TCS certificate within 15 days of uploading your return after you have uploaded the quarterly TDS return

Latest Update for Income Tax and TDS/TCS Return E-Filing:

The Indian government has introduced numerous amendments to the Income Tax and TDS policies, taking into account the current situation of taxpayers and businesses. Here are the latest Income tax and TDS, and TCS updates, including amendments, notifications, and announcements by the government that every taxpayer should know.

- The income tax department extended the last date to link PAN with Aadhaar is May 31, 2024. Read Also

- The Central Board of Direct Taxes (CBDT) has released a new version of ITR Form V for unverified electronically filed tax returns for the Assessment Year (AY) 2024-25. This update has been made through notification no.37/2024 F.No.370142/7/2024-TPL (5th Amendment rule). Read Circular Notification

- “The Income-tax notification No. 36/2024 F. No. 300196/21/2017-ITA-I for River Ganga (Rejuvenation, Protection and Management)”. Read Circular Notification

- “The notification No F. No. 225/196/2023/ITA-II for the Principal Secretary, Planning Department, Government of Uttar Pradesh.” Read more

- “The Income tax department has shared the notification no. 34 /2024 F. No. 370142/3/2024-TPL for any other amount not allowable under clause (h) of section 43B”. Read more

- “The Notification No. 33/2024 F.No. 503/2/1986-FTD-I for the avoidance of double taxation between India and Spain. Read more

- “The IT department has released the JSON schema for ITR-1 and ITR-4 forms for AY 2024-25. “Download Now

- “The Income tax notification No. 32 /2024 (F.No.165/1/2021-ITA-I) for the Press Trust of India Limited, New Delhi”. Read more

- “The Income tax department has shared the order to open all Income tax offices on March 29, 30 and 31, 2024”. Read order

- “Income tax notification no. 31/2024 [F. No. 203/22/2023/ITA-II] for the National Forensic Sciences University, Gandhinagar (PAN: AAALN3742Q).” Read more

- “Notification no. 30/2024 F. No. 203/20/2023/ITA-II for the Sardar Vallabhbhai National Institute of Technology, Surat (PAN: AAAJS1184P). Read more

Due Date for TDS & TCS Payment Deposit for Both Govt & Non-Government Firms

- The due date to submit the TCS deposit is the 7th of the succeeding month.

- TDS Deposit Due Date is as follows:

For non-government entities, the 7th of the succeeding month (except March, where the due date is set to be April 30th)

For Government Entities

- If paid via Challan, the 7th of next month

- If paid via book entry, the same day on which TDS is deducted

Updates on TDS and TCS from the Finance Ministry

- Circular No. 5 has been issued regarding the waiver of interest on delayed TDS/TCS payments due to technical issues. Read Circular

- “Government to infuse Rs 50,000 crores liquidity by reducing rates of TDS, for non-salaried specified payments made to residents, and rates of Tax Collection at Source for specified receipts, by 25% of the existing rates”

What is the Difference Between TDS & TCS Filing Forms?

You can comprehend the difference between TDS and TCS via the following illustration:

| Individuals or companies making the payment | TDS | TCS |

| Limits | Purchase of goods and services | Sale of goods and services |

| Transactions covered | Rent, commission, interest, rent, salaries, brokerage and more | Selling of toll tickets, forest products, cars, tendu leaves, minerals, liquor, timber, scrap, etc. |

| Time of Deduction | When payment is due or made, whichever comes sooner | During sale |

| Due dates | 7th of every month, though the returns have to be submitted quarterly | Deducted in the month in which the supply is received. Deposited to the Government within 10 days from the month’s end in which it is supplied. |

| Person responsible | Individuals or companies making the payment | Deducted in the month in which supply is received. Deposited to the Government within 10 days from the month’s end in which it is supplied. |

| Filing quarterly statements | Form 24Q (in case of salaries), Form 26Q (for others except salaries), and Form 27Q (for payments to NRIs) | Form 27EQ |

TCS & TDS Return Late Filing Fees :

As per Section 234E, the taxpayer must pay a late fee of INR 200 per day until the return. You also have to pay this fine every day of delay until the acceptable amount equals the actual TDS amount required to be paid.

For instance:

If the payable TDS amount from your side is INR 5000 on 1st March, but you pay the amount on 30th June, then the total calculation sums up to INR 200 X 122 days = INR 24,400. However, since this amount is higher than the actual TDS amount, i.e., INR 5000, you are only required to pay INR 5000 as the late filing fee. Apart from this, the interest will also be applicable alongside the penalty.

The interest rate details are given in the next section.

Interest on Late Payment of TDS / TCS

| Section | Nature of Default | Interest Subject to TDS/TCS amount | Interest period |

| 201 A | Non-deduction of tax at source (whole or part) | 1% per month | Starts from the date on which the tax was deductible to the actual date of deduction |

| After deduction of tax, non-payment/late payment of tax (whole or part) | 1.5 per month | Starts from the deduction date to the actual date of payment |

Note: The interest should be paid by the taxpayers before the filing of the TDS return.

For late payment of TDS after deduction under Section 201(1A), you have to pay interest at the rate of 1.5% per month starting from the date when it was deducted to the actual date of deposit. One must also note that the interest is calculated every month rather than on the number of days. Part of a month will also be considered a whole month.

For example

Imagine that your payable TDS amount is INR 3000, and it has been deducted on January 15th. Now, you have missed the actual date of the TDS deposit and paid this amount late on May 29th. So, the interest that you now have to pay sums up to INR 3000 X 1.5% per month X 5= INR 225.

“Month” is a vague term and has not been properly defined under the Income Tax Act of 1961. However, in many High Court Cases, the court has ordered that it should be considered as a period of thirty days, unlike the English calendar month.

The important thing to note here is that

The interest calculation for the payable TDS amount starts from the date when the TDS was deducted rather than the date on which it was due.

For instance

Suppose the due date of TDS submission or payment is set to be April 15th for the TDS deducted on March 30th. So, in such a scenario, the interest rate calculation will start from March 30th, instead of April 15th, for the late payment of TDS.

You might also consider a scenario where you miss the due date of the TDS payment by just one day. Suppose the due date of the TDS payment is May 10th for a TDS deducted on April 15th. Now imagine you somehow missed this date and made the TDS payment on the very next day, i.e., May 11th. Even in such a scenario, the interest calculation will start from April 15th, and you would be required to pay interest for two months, i.e., 1.5% per month X 2= 3%.

Therefore, you must never miss the last date of the TDS payment to avoid heavy interest and penalties.

Penalty

You might have to pay a penalty equal to the deducted/collected amount as per the rules of the Income Tax Act.

Prosecution (Sec 276B)

As per the prosecution (Sec 276B), if any person fails to pay the credit to the Central Government, then the TDS deducted by him as per the provisions of Chapter XVII-B, he/she will be entitled to receive rigorous punishment of a minimum of three months, which can be extended up to seven years. The punishment depends upon the circumstances of the investigation made by the designated tax authority/assessment officer.

Penalty For Late Filing of TDS Return

Penalty (Sec 234E)

The TDS deductee will be entitled to pay a penalty of INR 200/- per day till the day the full TDS amount is paid. However, the penalty shall not exceed the actual TDS amount.

Penalty (Sec 271H)

As per this rule, the Assessing Officer may direct a person who has failed to file the TDS payment on time with a minimum of INR 10,000, which can even be extended to INR 1,00,000.

If the following conditions are met, then no penalty will be levied (under section 271H) against late payment of TDS/TCS returns:

- The tax deducted at the source is required to be furnished to the credit of the government.

- No penalty will be levied if the interest and late filing fees are paid to the credit of the government.

- Before the expiration of one year, the TDS/TCS return has been filed after the due date.

Due Date of 15G/15H Form

15G/15H is a quarterly declaration form that is to be filed according to the due dates mentioned below. The due date for filing 15g/15h declarations received by a taxpayer from 1/04/2019 to 30/06/2019 as well as those received after that, has been specified in the notification released by the government. The same has been updated here.

| S.No. | Scenarios | Original Due Date |

| 1. | For 15G/H Received from 1/04/2025 to 30/06/2025 | 15th July 2025 |

| 2. | For 15G/H Received from 01/07/2025 to 30/09/2025 | 15th October 2025 |

| 3. | For 15G/H Received from 01/10/2025 to 30/12/2025 | 15th January 2026 |

| 4. | For For 15G/H Received from 01/01/2026 to 31/03/2026 | 30th April 2026 |

TDS on Purchase of Immovable Property

For the purchase of immovable property on which TDS is applicable, the return, along with payment of TDS, must be made before the 30th of the next month. For instance, TDS for a property that was purchased in May must be deposited by the 30th of June.

July 14, 2020

What is the time limit for filing TDS/TCS return for the Quarter 1 A.Y. 2021-22?

July 16, 2020

31st July 2020 is last date for 1st Quarter TDS/TCS Return for AY 2021-22

July 14, 2020

SIR 2020-2021 Q1 FILLING LAST DATE?

July 11, 2020

Dear Sir,

TDS return Q1 F. Y 2020-21 has been latest date is 31st july 2020. ?

Regards,

Ranjan Dey

July 16, 2020

Yes, 31st July 2020 is last date for 1st quarter of FY 2020-21

June 30, 2020

Sir

TDS Return Of F Y -19-20 Extendeed 31.july20 Is it also last date for 15G/15H ?

July 4, 2020

No such extension made for 15G/15H

June 26, 2020

Dear Sir,

TDS return 4Q F. Y 2019-20 has been changed now latest date is 31st july 2020. is it true ?

Regards,

Sandeep Kumar

June 29, 2020

Yes Latest date is 31st July 2020

April 20, 2019

Sir

I have filed e-filing of 15G/H statements for Q4-FY- 2018-19 on incometaxindiaefiling.com.

transaction number has been generated.

DO I NEED TO SEND THE STATEMENTS OF 15G/H TO NSDL OR ANYONE IN HARDCOPY OR SOFT COPY?

April 22, 2019

As you have filed a statement on income tax website online then you not need to send any acknowledgment to NSDL.

March 5, 2018

As amount has been paid in the month of January and also the TDS has been deducted at the time of payment so TDS return for the qtr. ending on 31/03/2018 to be filed on or before 15/05/2018.