What is GSTR-11?

GSTR-11 is defined as the return which must be filed by the person who has issued his UIN (Unique Identity Number) to get a refund under GST for the goods and services bought by them in India.

Who are the UIN holders under the GST Act?

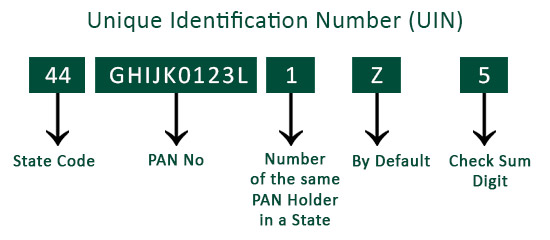

UIN (Unique Identity Number) is a special categorization made for foreign diplomatic projects and representative who are likely to pay taxes in Indian territory. It is a 15 digit alpha-numeric code to identify the GST exempted person.

Given below are the organizations that can apply for a UIN:

-

-

A specialized agency of UNO (United Nations Organization)

-

Consulate or Embassy of foreign countries

-

Any other person or class of persons as notified by the Commissioner

-

A Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947

-

Purpose of UIN

The main aim of issuing UIN is that any amount of tax collected from the person holding UIN is refunded back to them. But the GSTR-11 must be filed by them to claim the refund of GST paid by them.

What is the due date for filing GSTR-11?

The due date for filing GSTR-11 is 28th of every month succeeding the month in which inward supply is received by the UIN holders.

What are the details that must be provided in GSTR-11?

There are total 4 sections in GSTR-11:

a. UIN- Unique Identity Number which is given to the notified person by the GST administration which should be filed in here.

b. Name of the person who has UIN- At the time of filing return, the name of the person will be auto-filled because of this.

c. Details of inward supplies received- Here must provide GSTIN number of the suppliers. While filing the GSTIN number, the details will be auto-filled from GSTR 1 return form.

d. UIN holder cannot add/update details here-

-

-

Refund amount- the refund amount will get auto computed here. You must provide your bank details for the credit of such refund into your bank account.

-

Once all the details are provided correctly, then the taxpayer must sign digitally either via digital signature certificate (DSC) or Aadhaar based signature verification to authenticate the return.

-