The introduction of the Goods and Services Tax (GST) has brought about a significant transformation in India’s indirect tax system, implementing an integrated (single-point levy) Goods and Services Tax. Within this adaptive Tax System, the GSTR-9 and GSTR-9C forms play a crucial job in assuring compliance and transparency under the GST ecosystem. In this case, the GSTR 9C Due Date must be filed no later than 31st December of the financial year 2025-26, following the audited year. Depending on the circumstances, the government can extend the due date.

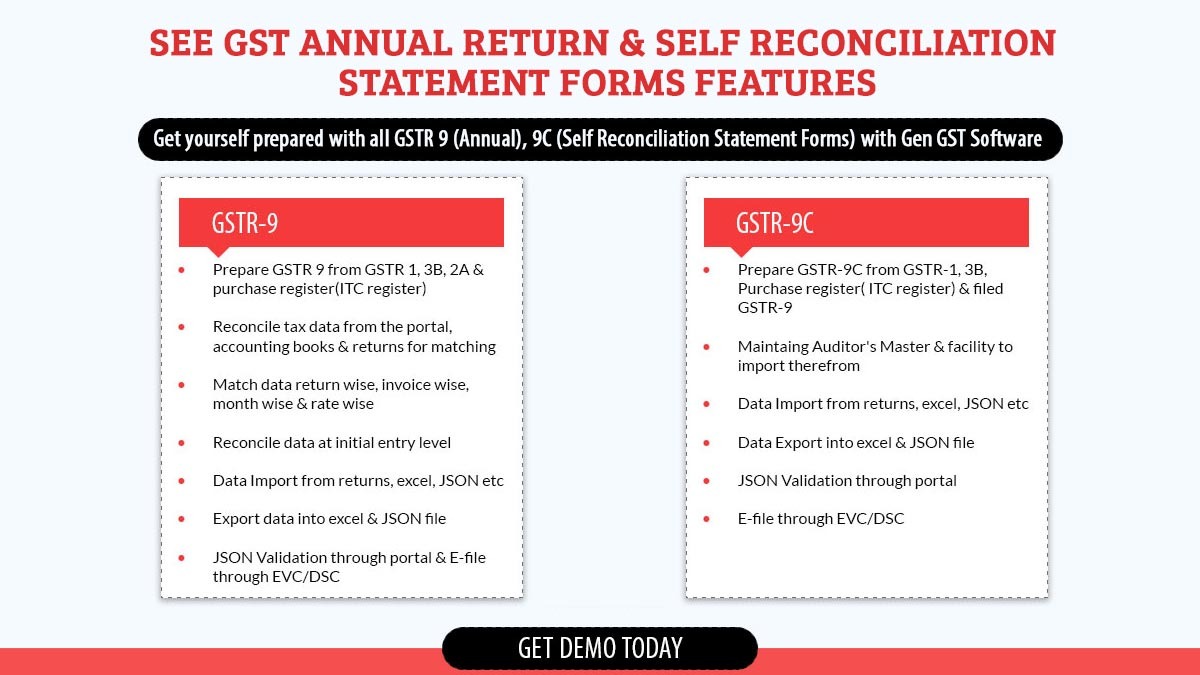

GSTR-9 furnishes a comprehensive brief of a taxpayer’s yearly GST transactions, whereas GSTR-9C coordinates such transactions with the Self Reconciliation Statement certificate, the audited Financial refund form. It is imperative for firms functioning as per the GST structure to have a comprehensive understanding of these forms and file them accurately.

For businesses, one of the important facets of GST regulation is the filing of annual returns the GSTR-9C form is included in this. This form is specifically created to integrate the taxpayer’s yearly returns with the audited financial records. This article provides the details of the due date for filing the annual return form of GSTR-9C, providing an understanding to help companies monitor compliance.

What Is GSTR 9C (Self Reconciliation Statement Form) under GST?

GSTR-9C is a statement that reconciles and aligns the financial records of businesses registered under GST. It is required to be submitted annually. This process involves carefully integrating the information provided in the annual return (GSTR-9) with the audited financial statements. The form consists of two sections: Part A, which reconciles the revenue, and Part B, which reconciles the input tax credit (ITC).

GSTR-9C serves as a yearly Self Reconciliation Statement for dealers whose turnover exceeds 5 crores in a financial year. The deadline for filing the GSTR-9C annual return form is mentioned in notification No. 49/2018 Central tax dated September 13, 2018.

The CA Portal provides comprehensive information about the due date for the GSTR-9C Annual Return Form, along with a step-by-step guide on how to file the form, including helpful screenshots. The GSTR-9C form also includes a reconciliation statement for turnover, input tax credits, and other tax payments.

Read Also: GSTR 9 Annual Return Form Due Date

Who is Required to File the GSTR 9C (GST Audit Form)?

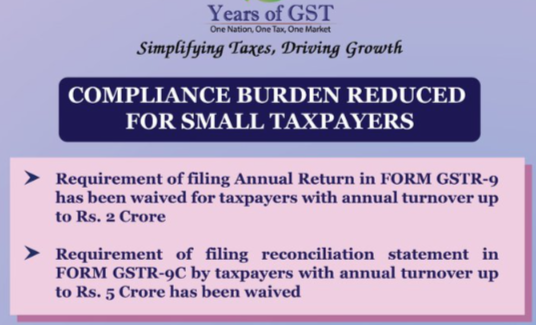

The Central Board of Indirect Taxes and Customs (CBIC) has waived the filing of annual returns through Form GSTR-9 and GSTR-9C for turnovers up to 2 crores and 5 crores, respectively. This was announced as the 6th anniversary of the implementation of the Goods and Services Tax (“GST”).

All those dealers having turnover below Rs. 5 crores in the financial year 2022-23 should file the GSTR 9C form along with a reconciliation statement and certification of an audit.

| Period | Filing | |

|---|---|---|

| Up to 2 Cr. | N/A | |

| More than 2Cr. – 5 Cr. | Optional(Benefit Given) | |

| More than 5Cr. | Filling is mandatory |

Using CBIC to Manage Your GSTR 9C Submission Requirements

To simplify the process of filing GSTR-9C, the Central Board of Indirect Taxes and Customs (CBIC) has instructed various measures. Here are some ways to streamline the process of the GSTR-9 submission.

- Consistently organize and match the accounts with the returns to prevent any last-minute rush or mistakes.

- Employ automated accounting and reconciliation software to facilitate smooth and precise data integration.

- Keep thorough records of all financial transactions and supporting paperwork, as they may be necessary during the audit.

- Take advantage of the offline utility tool offered by the GST portal to simplify the preparation and submission of GSTR-9C.

- Seek aid from experts, such as chartered accountants, to ensure precise data input and filing.

Build Professional Website For Your Accounting Firm at Afftable cost

Need to File Your Credentials And Documents of GSTR 9C

To file GSTR-9C, the following credentials and essentials are required:

- The GSTIN (Goods and Services Tax Identification Number) belongs to the registered taxpayer.

- The login credentials (username and password) are required to access the GST portal.

- A digital signature certificate (DSC) is used for the purpose of authentication.

- The audited yearly financial statements, which include the balance sheet, profit and loss account, and cash flow statement.

- Information regarding all invoices, debit notes, credit notes, and other pertinent documents for the audited financial year.

- Comprehensive details regarding both outward and inward supplies made throughout the financial year.

- Information about the Input Tax Credit (ITC) that was claimed and utilized during the financial year.

- A statement that reconciles the audited financial statements with the annual return in Form GSTR-9.

- Any additional relevant documents requested by the auditor or the GST authorities.

53rd GST Council Meeting: Several Key Recommendations

“The relaxations provided in FY 2023-24 for FORM GSTR-9 and FORM GSTR-9C have been announced by the 53rd GST Council Meeting. It comprises the exemption from filing the annual return for taxpayers having an aggregate yearly turnover of up to two crore rupees. Such revisions have been made by the Council to streamline the compliance load on smaller taxpayers.”

“The 53rd meeting of the GST Council, chaired by Union Finance Minister Nirmala Sitharaman, made several key recommendations to improve GST compliance and facilitate business operations. Here are the highlights: Official Press Release“

GSTR 9C Due Date for FY 2025-26

| Form Name | Return Annually | Updated Due Date |

|---|---|---|

| GSTR 9C | FY 2025-26 | 31st December 2026 |

| GSTR 9C | FY 2024-25 | 31st December 2025 |

| GSTR 9C | FY 2023-24 | 31st December 2024 |

| GSTR 9C | FY 2022-23 | 31st December 2023 | GSTR 9C | FY 2021-22 | 31st December 2022 |

Key Differences Between GSTR 9 and GSTR 9C

GSTR-9 and GSTR-9C are essential GST filings that individuals registered under GST must complete. However, they serve different purposes and have specific requirements.

GSTR-9 is an annual return that presents a summary of all the supplies made, both outward and inward, throughout the financial year. It also includes information regarding the payment of GST and the utilization of Input Tax Credit (ITC).

All regular GST-registered taxpayers, excluding Input Service Distributors (ISDs), Casual Taxable Persons, and Non-Resident Taxable Persons, are obligated to file GSTR-9.

On the other hand, GSTR-9C is a comprehensive reconciliation statement that ensures the accuracy and alignment of the GST payments and ITC claims with the audited financial statements.

Latest News/Updates:

- “The GST Network (GSTN) has announced an Advisory to file pending returns before the expiry of three years. GST returns can only be filed within three years from their due dates.” Read Official copy of the Advisory

- “Features include importing GST data, previewing the returns before submitting, and generating a JSON file for easy GST portal uploading. The GSTR 9C offline utility helps taxpayers save time and effort when filing their returns. All of this makes the process easier and more efficient.”Features include importing GST data, previewing the returns before submitting, and generating a JSON file for easy GST portal uploading. The GSTR 9C offline utility helps taxpayers save time and effort when filing their returns. All of this makes the process easier and more efficient.”

Find a complete step by step guide to file GSTR 9C along with guided screenshots for the taxpayers here.

April 25, 2020

Your page is very cool, i have bookmarked it.

February 3, 2020

Is GST Annual Return GSTR-9 compulsory for whose Turnover is less than 2 Cr. ?????

Can we file voluntarily to this????

February 3, 2020

GST Annual Return GSTR-9 is not mandatory for turnover less than 2 cr. Yes you can voluntary file this.

November 27, 2019

for financial year consideration for 2017-2018 for gst audit applicability from april to march turnover to be considered or july to march turnover is considered

November 28, 2019

For the purpose of finding out the turnover limit for GST applicability for Financial Year 2017-18, it includes the first quarter of 2017-2018 i.e. 1st April 2017 to 30th June 2017, before GST was implemented.

January 21, 2020

As per Press Release dated 03/07/2019 the T/O for 2017-18 is to be considered from July 17 to Mar 18 i.e. Excluding T/O of Q1 for 2017-18.

November 28, 2019

For the purpose of finding out the turnover limit for GST applicability for Financial Year 2017-18, it includes the first quarter of 2017-2018 i.e. 1st April 2017 to 30th June 2017, before GST was implemented.

May 30, 2019

There is any chance that gst annual return due date might be extended.

May 31, 2019

The GST annual return due date is 30th June 2018. Currently no update by CBIC regarding extention of the due date and you will be notified once there is any update regarding this.

January 4, 2019

Sir plz update about the due date for filling GST audit report because above notification is only for GST annual return only.

January 4, 2019

GSTR 9C is the annual return audit form. So the annual return audit form also filing on the same due date (30th June 2019).