Implementing the Goods and Services Tax (GST) system in India has resulted in positive changes to the country’s taxation system. The government has introduced the GST Composition Scheme to simplify tax compliance for small taxpayers. This scheme offers two types of GST registration: Regular GST registration and Composition Scheme registration. Under the Composition Scheme, dealers can file their GST return annually using Form GSTR 4. All the assesses covered under the composition scheme file the annual GST (Goods and Services Tax) returns filing due date of the GSTR 4 form till 30th April for every financial year, FY 2025-26.

Taxpayers who have chosen the Composition Scheme must file the GSTR 4 return annually. Before the financial year 2018-19, this return was filed quarterly until it was replaced by CMP 08. The Composition Scheme enables taxpayers with an annual turnover of up to Rs. 1.5 crore to adopt a simplified tax structure and submit quarterly returns using the GSTR-4 form. Keeping track of the GSTR 4 due date is crucial to ensure tax compliance and avoid penalties.

What Is GSTR-4?

Form GSTR-4 (Annual Return) is an annual return that is mandated to be filed once, for each fiscal year, by taxpayers who have opted for the composition scheme at the time of the financial year, for were in the Composition scheme for any course during the stated financial year, from 1st April, 2019 onwards. These taxpayers are needed to provide particulars for the summary of outward supplies, Inward supplies, import of services, and supplies drawing a reverse charge in this form.

Get Your Accounting Service Website Done at a Low Cost Today!

Who Is Eligible to File GSTR-4?

Taxpayers who have opted for the Composition Scheme under the Goods and Services Tax (GST) are eligible to file GSTR-4, which provides certain benefits, such as reduced compliance requirements and lower tax rates. The due date for filing Form GSTR-4 (Annual Return) is the 30th of the month following the financial year, unless extended by the government. This also includes the special composition scheme notified for service providers, effective from the financial year 2025-26, as per the CGST (Rate) notification number 2/2019 dated March 7, 2020.

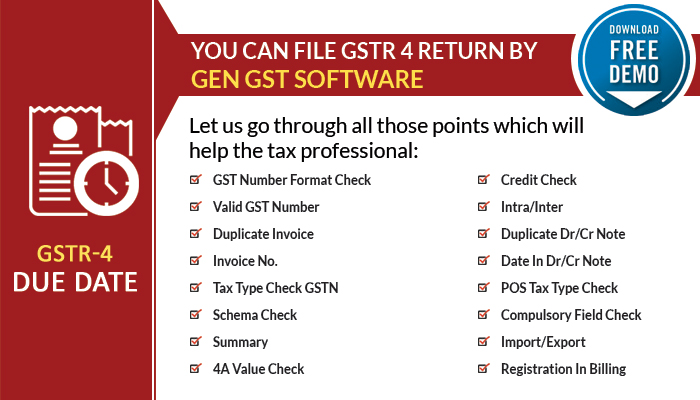

Composition Taxpayers Can Now File GSTR-4 on the GST Portal

The Central Board of Indirect Taxes and Customs (CBIC) has introduced an option for the composition taxpayers to file Form GSTR 4 online on the GST portal. The GSTR 4 form is required to be filed by all the composition taxpayers annually for each financial year, with effect from 1st April 2019.

Read Also: Latest Due Date of CMP-08 Return Filing

Who Can File NIL Under Form GSTR-4?

Assessees who meet any of the following conditions in each quarter of the financial year can file a NIL form under GSTR-4:

- No outward supply made

- No goods/services received

- No other liabilities to report

- All Form CMP-08 filed as Nil.

GSTR 4 Annual Return Due Date For FY 2025-26

| Period | Due Date |

|---|---|

| Annual Return FY 2025-26 | 30th June 2026 |

| Annual Return FY 2024-25 | 30th June 2025 View more |

| Annual Return FY 2023-24 | 30th April 2024 |

| Annual Return FY 2022-23 | 30th April 2023 |

The last date to file the GSTR 4 annual return of the form is the 30th of the month in which it was previously filed last year.

Latest Update :

“The GST Network (GSTN) has announced an Advisory to file pending returns before the expiry of three years. GST returns can only be filed within three years from their due dates.” Read Official copy of the Advisory

The GST 53rd Council meeting rescheduled the GSTR-4 due date from April 30th to June 30th, starting from the fiscal year 2024-25. View more

Legal Consequences and Penalty of Not Filing GSTR-4 Before the Due Date?

Penalty

Following the latest update, a late fee of Rs. 50 per day is imposed, up to a maximum of Rs. 2,000. If there is no tax liability, the maximum late charge is Rs. 500.

Previously, a late fee of Rs. 200 per day was charged for the late filing of GSTR-4. The maximum late fee was capped at Rs. 5,000.

Consequences of Missing the GSTR 4 Due Date

There can be various adverse outcomes for taxpayers who fail to file their GSTR-4 returns within the designated deadline. These repercussions encompass –

- Late Fees: Taxpayers will be required to pay a late fee of Rs. 200 per day of delay (Rs. 100 for CGST and Rs. 100 for SGST), with a maximum of Rs. 5,000. Late fees for IGST will be charged separately.

- Interest Charges: Interest will be levied at a rate of 18% per annum on the outstanding tax liability.

- Legal Consequences: Continuous non-compliance may result in legal actions, including tax recovery and cancellation of GST registration.

How Form GSTR 4 is Different from the Quarterly Returns

Form GSTR 4 is quite different from the returns that are required to be filed quarterly.

- The form can be filled by the composition taxpayers starting from 31st August 2019.

- For the period before that, the assesses were required to file GSTR 4 returns quarterly. Now the assessees are required to file form CMP 08, quarterly and form GSTR 4, annually.

Fee and penalty for late GSTR 4 online filing

If you fail to file GSTR 4 within the due date, then you are required to file a penalty of Rs. 200 per day. Rs. 5000 is the maximum fee that can be charged. Indeed, if you do not file GSTR 4 for one quarter, then you cannot file it for the subsequent quarter. Hence, it is crucial to furnish your GSTR 4 returns within the specified duration for each quarter.

For registering in the composition scheme from the earlier Rs. 1 crore to Rs. 1.5 crores, there is an upsurge in the minimum threshold. It will lead to more business entities opting for this scheme,e and the number of GSTR 4 filings is anticipated to move up in the forthcoming days.

August 5, 2019

I HAVE SELL ONLY EXEMPTED VALUE OF GOODS.WHAT ENTRY ARE MADE IN CMP-8? BECAUSE WHEN I PUT THIS INTO OUTWARD SUPPLY WITH 0 TAXES.AFTER THE SUBMISSION BUTTON.THE ERROR OCCUR SAYS CASH BALANCE IS NOT AVAILABLE.WHAT SHOULD I DO?FILE NILL RETURN OR WAIT FOR A NEW UPDATION.

August 6, 2019

If you are registered as a composition dealer then taxes would be payable in aggregate turnover including on exempt supplies too. So in your case, tax should be payable on aggregate turnover of exempted supply.

July 31, 2019

In CMP 08 at S.No. 1 we have to write outward Supplies (including exempt Supplies). My concern …Should I pay tax on exempt supply also or I should pay tax on taxable supply only ? Suppose my total sales are 100 out of which 30 is exempt sales,should I pay tax on 70 Rs. or on 100 Rs.

August 1, 2019

In composition scheme under GST, composition rate is applicable on both taxable and exempt supplies.so in your case, liability arises on Rs.100

July 26, 2019

gst portal does not show gst r4 so how can I file my 1st quarter 2019-20 return last date is 18.07.2019

July 26, 2019

From F/Y 2019-20 onwards GSTR-4 becomes annual return & in place of

GSTR-4, CMP-08 will come which will be filed on a quarterly basis.

Until now CMP-08 is not available on the portal you may wait or may create

challan of the taxable amount

July 21, 2019

A composition Dealer has missed sale of 10 lakhs, (shown less) in March19. Now he want to make payment of tax with interest., How to make payment? In which chalan payment is to be done.

In new form CMP 08 there is no col. for amendment related to earlier returns filed. If payment on line is made, it will remain in cash ledger. Unless it is adjusted against liability of March 19, though payment is made now, the interest will attract till its adjustment.

Kindly suggest.

July 22, 2019

As the facility to upload data in CMP-08 is not available on portal, the only solution left is to create the challan for the same amount

July 18, 2019

NOW YOU NEED TO FILE CMP-08.

July 17, 2019

gst portal does not show gst r4 so how can I file my 1st quarter 2019-20 return last date is 18.07.2019

July 18, 2019

Please note that from 01.04.2019, composition dealers are required to file CMP 08 on quarterly basis. However, this form is not yet enabled on GST portal.

July 17, 2019

Sir, We started business under Composition scheme and purchased Capital goods like Machinery worth-10Lakh, do we need to update capital goods purchases in Quarterly returns? and sales are less than 1Lakh. are there any complications with this huge difference between Sales and purchases? please confirm and advise us.

July 18, 2019

IN CMP-08 ONLY INWARDS SUPPLIES LIABLE TO REVERSE CHARGE HAS TO BE REPORTED.

July 14, 2019

if I don’t pay composition tax just because CMP-08 is not available on portal , Shall I be liable to pay interest and penalty for late payment of tax ? Or I should pay composition tax through challan before 18th july as I was doing before this quarter?

July 15, 2019

Sir as CMP -08 is not available on portal, So in good practice you

should pay the amount of tax through challan in respective heads before

18/07/2019.

July 14, 2019

it is applicable to composite scheme to pay challan previous format now cmp 08 form is not getting in gst site

July 15, 2019

Sir there no any clarification provided by portal up till now

July 14, 2019

CMP-08 is still not available on portal. Kindly guide where it will reflect and when? Due date is 18th July?Thanks

July 15, 2019

Sir as CMP -08 is not available on portal, So in good practice you

should pay the amount of tax through challan in respective heads before

18/07/2019.

July 14, 2019

Sir, I am in composition schem. In the GST portal, when I tried to open apr-jun 2019 quarter, there is no link to file GSTR4. Is there no need file GSTR4 prevoius Quarter?

July 15, 2019

Sir From F/Y 2019-20 onwards GTSR-4 is now treated as annual return

and in place of GSTR-4, CMP-08 is provided but it is not available on

portal, So in good practice you should pay the amount of tax through

challan in respective heads before 18/07/2019.

July 16, 2019

Sir, i started business in April 2019. and applied for GST on 25th April 2019 under composition.

i am rice supplier. All sales during the quarter is of exempt goods. Also purchases are also exempt one.

Since no GSTR 4 link is available on site, do i need to make any reporting on gst portal as no amount of tax is due as entire sales during the quarter is exempt supply only.

July 16, 2019

Since CMP-08 is not enabled on the portal right now, So you can wait for

the same on the portal

July 12, 2019

which dealer require to procees new prototype under gst

July 12, 2019

it is applicable to all the composition dealers

July 11, 2019

Sir

I am a composition dealer, Monthly Turnover is below One Lac and Filing NIL Quarterly Returns ,is it ok or have to pay 1% gst ? Since Exempted up to Rs.20 Lac per Year

July 11, 2019

First of all, we would suggest you to unregister yourself from the GST as you have less than the threshold limit to avoid compliance. Also if you are doing sales of less than 1 lac still you have to file GST as per the required format and in no way, you should file the NIL returns as you have to file whatever the sales you are doing.

July 11, 2019

GSTR4 online filling option not available in the GST portal after login in “file return section I selected FY2019-20 and Apr-June”showing only GSTR4A, not showing file a return online or offline, as a Composition dealer I have to file the return before 18th of July for Apr-June quarter, when can I get the option to enter the sales and figures, or nil returns send yours valuable suggestions.

July 11, 2019

Sir from F/Y 2019-20, GSTR-4 is Now Annual return which is to be filed by 30th of April 2020 and for Quarterly filing CMP-08 is to be issued by portal shortly. So kindly wait for the same.

July 13, 2019

dear dir, thanking for your kind information

July 10, 2019

Hi, just need to re-confirm Sir that GSTR 4 is not required to be filed (Further the same is also not available on portal) and only CMP 08 to be filed for Apr Jun 2019. Can you also give me reference to notification from board, as the link in this blog seems to be different notification.

July 10, 2019

Refer to the notification no. 31/2019 Central tax dated 28.06.2019.

http://www.cbic.gov.in/resources//htdocs-cbec/gst/notfctn-31-central-tax-english-2019.pdf;jsessionid=AC7436697DD0BFAC5B0BD95E1CB416E4

July 9, 2019

Respected sir ,

Thank you for giving a lots of imformations about Gst related problems..

sir i want to know that about me ,iam a small business man cum acountant of 5,lkh .interstate purchaser.

what is a tax amount fix for my business… how i issue a bills for customer.

July 10, 2019

Please specify whether you are registered under GST or not. The tax rate is not fixed for a particular business. It depends upon the goods and services you deal in. If you are registered under GST, for supplying accounting services, 18% GST has to be charged.

July 9, 2019

should I pay tax through CMP-08 or through Services-> Payments-> Create challan, i heard that composition dealer should pay tax Through CMP-08 AND not through Challan

July 10, 2019

For regular dealers, the tax has to be paid through challan. For composition dealers, CMP 08 has to be filed which is a challan cum statement.

July 7, 2019

GSTR4 online filling option not available in the GST portal after login in “file return section I selected FY2019-20 and Apr-June”showing only GSTR4A, not showing file a return online or offline, as a Composition dealer I have to file the return before 18th of July for Apr-June quarter, when can I get the option to enter the sales and figures.

July 8, 2019

You have to file CMP 08 from April 2019 onwards on quarterly basis.

July 9, 2019

I am a composition dealer with 1% tax(Manufacturing sector), do I need to file CMP 08? if not when can I get GSTR4 online filling option which is not available now in the GST portal?

July 10, 2019

You have to file CMP 08

July 5, 2019

Sir,

How to pay GST tax for the month of April to June 19 ?

July 8, 2019

Go to Services-> Payments-> Create challan.

July 4, 2019

tax will be paid through challan as we pay in current system or tax will also be paid through CMP-08 and no need to fill challan to pay tax now?

July 5, 2019

In the month of April 2019, a new return filing process has been released by the department for composition dealer, wherein composition dealer should challan cum return CMP-08 on quarterly basis in spite of filing GSTR-4. CMP-08 will work for both as a challan for payment and as a return.

July 4, 2019

Sir, I purchased machinery for business with composition scheme, can I get input credit on purchase of capital goods in composition scheme

July 5, 2019

No credit will be allowed in case of composition dealers.

July 1, 2019

I have to file zero tax return as there is no business in this quarter. How to do that?

July 1, 2019

You have to click on “yes” when the system asks whether you want to file a nil return.

June 28, 2019

Sir, in composition scheme GSTR 4 Form Qtr. Apr. to Jun. 2019 what will be procedure to fill return. means the procedure will same as past or will be difference because in this return service and goods dealers both are fill this form.

July 2, 2019

Same Procedure has to be followed to file GSTR-4 for QTR Apr-June 2019

January 17, 2019

Can I file Gstr 4 without Purchase Detail as we are not getting any kind of credit and it is very hectic to put all these purchase bills?

January 17, 2019

No nothing has been mentioned in this regard as per declaration provided by govt. earlier for not filling purchase details in table 4A.

January 10, 2019

Dear Sir,

GSTR 4 For the month of OCT TO DEC 2018 , Normal Purachse Details Disclosed Compulsory Or Not???

January 15, 2019

No nothing has been mentioned in this regard as per declaration provided by govt. earlier for not filling purchase details in table 4A. As the same ruling is still in continuation, it is not required to file such details.

January 4, 2019

Is it mandatory to fill details of the bill to bill purchases for GSTR 4 return for the period Oct-Dec 2018? Kindly help

January 7, 2019

No nothing has been mentioned in this regard as per declaration provided by govt. earlier for not filling purchase details in table 4A. As the same ruling is still in continuation, it is not required to file such details.

January 2, 2019

Sir is it mandatory filed purchase details from period oct-dec 2018 (3rd Quarter)

January 3, 2019

No nothing has been mentioned in this regard as per declaration provided by govt. earlier for not filling purchase details in table 4A. As the same ruling is still in continuation, it is not required to file such details.

October 17, 2018

GSTR 4 Oct to Dec return filing extension due date details?

October 22, 2018

GSTR 4 return filled in between 11th and 18th of the month. So GSTR 4 October to December 2018 return filing due date is 18th January 2019.

October 12, 2018

sir,

How I file July 18 to September 18 return. which figure enter the only sale and purchase both details fill in this return so, please tell me how can I file.

October 16, 2018

For filing sale details you need to enter consolidated turnover in

taxable supplies tab in relevant percentage applicable on you and to

fill the purchase details you need to enter the details in relevant

sections i.e. B2B, B2BUR, IMPS, IMPG etc. as per category of purchase

you deal in.

October 10, 2018

Sir, please contact GST portal helpdesk for the same as no cash balance is required in case of nil return.

July 11, 2018

How to use my itc of GST , when I optin composition scheme dates 1.10.2017. July to Sept, 2017 I am regular taxpayer and I have ITC .

July 13, 2018

As you are regd. under composition scheme, you are not allowed to avail ITC , and at the time of transition from regular to composition , assesee need to pay sum equal to stand as itc in stock.

July 11, 2018

Hello sir, I ask to GST help desk to can we have to file purchase details on GSTR 4 for 1st quarter 2018 ? They said it’s not necessary. What you say ?

July 11, 2018

You have to show details in column 4 of GSTR-4.

July 10, 2018

Facility to opt out from composition can be opted at the beginning of the financial year only. Credit of input can be claimed for the stock in hand as on the last date of the financial year.

July 6, 2018

sir april to june 2018 gstr4 main purchase details dena parega

July 6, 2018

Whether purchase bill details should be entered in GSTR-4 for the 1st QTR i.e April – June 2018

July 10, 2018

You have to show details in column 4 of GSTR-4.

July 5, 2018

I will be wrongly submitted GSTR-4 for April to June 2018. Kindly reset the submission process.

May 28, 2018

As you have registered on 7th of September so liability to file quarterly return related to July-Sep return arise on you and as you file the return after due date that’s why late fees has been imposed, and if there any technical issue relating to your return period not showing on portal, you have to contact to GSTN.

April 19, 2018

i lapsed filing gstr4, now when can i file gstr4 again.

April 19, 2018

You can file it anytime with the payment of late fees.

April 18, 2018

My supplier generated one credit note for 03 items returned by me during 4th Qtr but there are 03 different involces(post GST)for the 03 items returned. While filling sheet 5B(CDNR) of GSTR_4 I have to repeat same credit note to fill relevant Invoices. But the system shows error saying note already exists in the FY.

All the items(seeds)returned are exempted from GST.In the above case I have left the sheet 5B (CDNR) blank. May it attract any problem in future. I have filed the return (4th Qtr) as well paid the tax amount.

April 18, 2018

As for each invoice you have to issue a seperate credit note, so you have to entered it accordingly.

April 18, 2018

sir mera gstr 4 fill karne par jaunary to march ka dropdown list show nhi ho rha, ab kya karna hoga meko

April 18, 2018

From January to March 2018, you have to file GSTR-4 by generating JSON file through the dept. utility.

April 17, 2018

In quarter 4 F.Y 2017-18 , We have not entered purchase detail GSTR 4 , its problem for us in future , explain sir.

April 13, 2018

Dear sir..

I m composite delear and I want fill quarterly return jan to march if i miss 18th april what am i do ans plz

April 13, 2018

In delay in filing return for the 4th quarter, you will be charged late fee and interest.

April 9, 2018

GSTR-4 has to be filed quarterly, so the quarterly turnover has to be reported.

April 3, 2018

As such no ITC will be available on purchases, but for reporting purpose you can show that.

February 13, 2018

You have to show details in column 4 of GSTR-4

February 9, 2018

In Jan to March, we have to put purchase details also in composition scheme ?

February 13, 2018

Yes, in every qtr’s return you have to show all purchase details.

April 6, 2018

sir,

after entering purchase details(Reverse Charge – NO) , when i click GET SUMMARY Button it is shown in Grand Total Rs.XXXX(Tax Amount in Purchase+Tax Amount in Turnover i.e.,1% ) shall we need to pay tax amount Rs.XXXX (Including Tax in Purchases also ) Sir?

April 9, 2018

Only purchases covered under RCM, being eligible for payment of tax by composition taxpayer, tax on normal purchases need not to be paid.

February 1, 2018

Hello Sir

i am under 20 lakh turnover but we migrated number in to gst regular type number and i only gstr 3b july 17 file but today i want to do application into composition scheme can do ? and previous return how to do maintain suggests me.

February 1, 2018

Till the month in which you opt for composition you have to file all the due returns and from the beginning of next month from applying for composition, you have to be treated as composition dealer.

January 15, 2018

I will be submitted GSTR 4 with the reverse charge of purchase- so total GST is charged Rs.60000/- but sir MY business is Medical Stores So I have purchase GST paid Bills. But I have filled wrongly GSTR 4 . so please send the solution.

January 16, 2018

You can only make changes during filing of next quarter’s return.

January 12, 2018

Sir, I was submitted wrong GSTR4 for JUL- SEP, but I do not file return yet, help me pls, what can I do?

January 12, 2018

You can reset the return and then make the required changes.

October 19, 2019

i am doing the same but an error is come in the gst portal i.e. error no. RET00009. Plz tell me what i do. i also called the gst customer care but no response receive from them.

October 21, 2019

This is a technical error on the part of GST portal only. You can raise an error ticket on the department’s website.

January 4, 2018

I have purchased 14 lakh rs or I have sale 950000 rs my GST no was issue on Oct. My total sales or purchase are for six months July to Dec so which amount I have to pay for tax under composition scheme

January 5, 2018

You will be liable to pay tax under composition scheme only from the date of registration i.e. from oct.

July 23, 2019

NOT ALLOWED IN ITC IN COMPOSITION SCHEME Rs-950000/- WITH 1%

July 26, 2019

Please specify the Question Correctly