The Institute of Chartered Accountants of India (ICAI) has released the date sheet for the ICAI Chartered Accountant (CA) September examinations 2025. You can check the following information online opening and closing dates for submitting exam application forms, correction window for applications, and exam dates and locations. Candidates wishing to apply for the examination can check the date sheet on the official ICAI website, icai.org.

Foundation Course Examination

[As per syllabus contained in the scheme notified by the Council under Regulation 25 F of the Chartered Accountants Regulations, 1988.]

| 16th, 18th, 20th & 22nd September 2025 |

Intermediate Course Examination

[As per syllabus contained in the scheme notified by the Council under Regulation 28 F of the Chartered Accountants Regulations, 1988.]

| Group -I | 4th, 7th & 9th September 2025 |

| Group -II | 11th, 13th & 15th September 2025 |

Final Course Examination –

| Group -I | 3rd, 6th & 8th September 2025 |

| Group -II | 0th, 12th & 14th September 2025 |

On Friday 5th September 2025 no examination is scheduled on account of Milad – un – Nabi, being a compulsory (gazetted) Central Government holiday as per F. No. 12/2/2023-JCA dated 9.7.2024 issued by the Ministry of Personnel, Public Grievance and Pensions, Government of India.

The same might be underscored that no change shall be there to the examination schedule in the event of any day of the examination schedule being declared a Public Holiday by the Central Government or any State Government / Local Bodies.

Paper(s) 3 & 4 of the Foundation Examination consists of 2 hours duration. However, all other examinations are of 3 hours duration, and the examination-wise timing(s) are cited below:

| Examination | Paper(s) | Exam. Timings (IST) | Duration |

| CA Foundation | Paper 1 & 2 | 2 PM to 5 PM | 3 Hours |

| – | Paper 3 & 4* | 2 PM to 4 PM | 2 Hours |

| CA Intermediate | All Papers | 2 PM to 5 PM | 3 Hours |

| CA Final | Paper 1 to 5 | 2 PM to 5 PM | 3 Hours |

| Paper 6 | 2 PM to 6 PM | 4 Hours |

There will not be any advance reading time in Papers 3 and 4 of the Foundation Examination, whereas, in all other papers/exams cited above, an advance reading time of 15 minutes will be provided from 1.45 PM (IST) to 2 PM (IST).

In the case of composite papers having both MCQ-based & Descriptive Question Papers, the seal of MCQs-based Question Papers shall be opened at 2 PM (IST), in other terms, no advance reading time for MCQ-based Question Papers will be provided.

PLACES OF EXAMINATION CENTRES OVERSEAS:

[FOR FOUNDATION AND INTERMEDIATE EXAMINATIONS ONLY]

The September 2024 Examinations will be held at 8 (Eight) overseas examination centres, namely:

Overseas – Abu Dhabi, Bahrain, Thimpu (Bhutan), Doha, Dubai, Kathmandu (Nepal), Kuwait and Muscat

The beginning timing of the examination at Abu Dhabi, Dubai, and Muscat Centres will be 12.30 PM, i.e., Abu Dhabi, Dubai, and Muscat local time corresponding/equivalent to 2 PM. (IST). The beginning timing of the examination at the Bahrain, Doha, and Kuwait Centre will be 11.30 AM, i.e., Bahrain / Doha / Kuwait local time corresponding/equivalent to 2 PM (IST). The beginning of the Examination Timing at the Kathmandu (Nepal) Centre will be 2.15 PM Nepal local time, corresponding/equivalent to 2 PM (IST). The Examination commencement timing at the Thimpu (Bhutan) Centre will be 2.30 PM Bhutan local time, corresponding/equivalent to 2 PM (IST).

The right to withdraw from any city/centre at any phase without furnishing any reason has been reserved by the council.

Online filling up of examination forms:

ICAI as a part of automation and platform consolidation, is pleased to announce that all candidates for Foundation and Intermediate Examinations will be directed to apply online at https://eservices.icai.org (Self Service Portal – SSP) for the September 2024 Exam and also file the examination fee online. Such forms are based on your eligibility for your course based on announcements and statutes. On SSP, these forms will be available, and you are asked to log in with your credentials (Username <SRN@icai.org> and password). These Exam forms shall be available in SSP effective set dates as publicised on www.icai.org.

Kindly Note: If you have never registered as a user in SSP, open the URL:

https://eservices.icai.org/EForms/configuredHtml/1666/57499/Registration.html?action=existing

In case you have forgotten or lost your password, use the option of forgot password. Students are asked to create a Username, register a Course, convert a Course, Revalidate, and update the Photo, Signature, and Address on SSP only.

Through the use of a VISA or Mastercard or MAESTRO Credit / Debit Card / Rupay Card / Net Banking / BHIM UPI, examination fees can be remitted online.

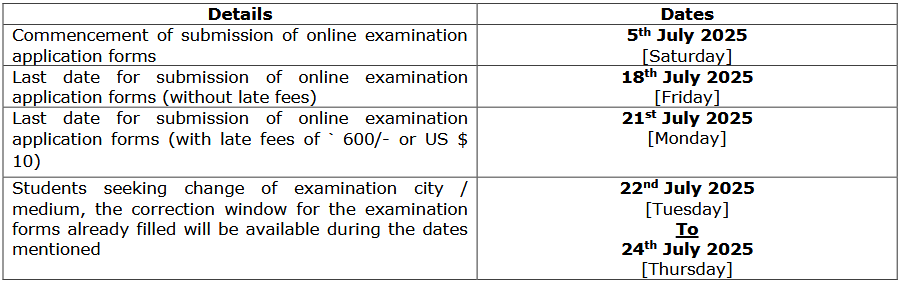

Opening & Closing Dates for Online Exam Application & Correction Window

Below are the proposed dates for consideration:

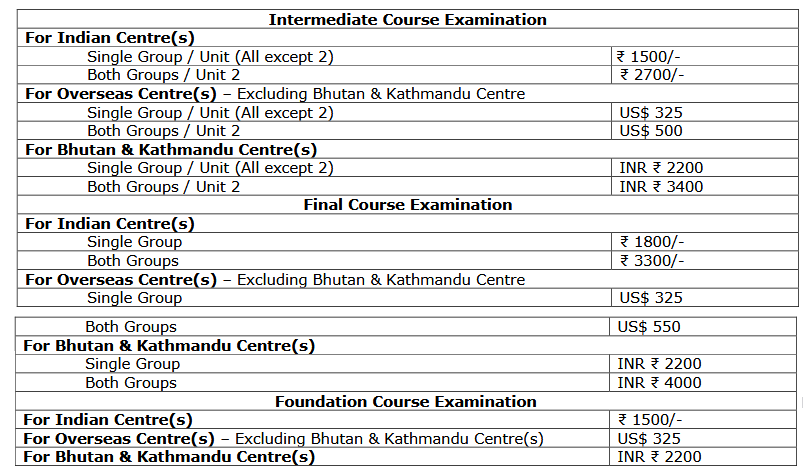

CA Examination Fee

For different courses, the examination fees are as under-

For late fee submission of the examination application form after the scheduled last date would be Rs 600 (for Indian / Bhutan / Kathmandu Centres) and US $ 10 (for Abroad Centres) as decided by the Council.

OPTION TO ANSWER PAPERS IN HINDI:

Candidates of Foundation and Intermediate Examinations shall be permitted to choose for English / Hindi medium for answering papers. Information shall be revealed in guidance notes hosted at https://eservices.icai.org

The candidates should learn those mentioned above and stay in touch with the Institute website www.icai.org.

More Additional information

If you need more information about examination centres, overseas examination centres, online exam forms, submission deadlines, exam fees, and answering options, visit: https://resource.cdn.icai.org/86215exam300525.pdf