The Goods and Services Tax (GST) in India offers a more comprehensive and more formalized indirect tax structure without the cascading effects of the erstwhile VAT regime. The GST categorises the supply of goods and services under four tax slabs 5%, 12%, 18%, and 28%. In technical terms, GST is a multi-stage destination-based tax levied on every value addition stage. The GST was touted as a major reform towards the formalization of the unorganized sector, as well as making business operations easier and more accountable. And it is not just the common taxpayers and business owners, GST has equally impacted the legal community too.

Although the initial assumption was that individual lawyers and law firms were outside the GST Framework, it is now clear that the Central Goods and Services Tax Act subsumes advocates and services provided by legal advisors, lawyers or law firms. GST On Lawyers, Advocates and Legal Advisers will be levied on the following entities and services.

GST on Individual Advocates, Senior Advocates and Firms of Advocates

The Central Goods and Service Tax Act does conceal the legal services furnished via the individual advocate, firm of advocates, or senior advocates by levying 18% on them. This article elaborates on the applicability, exemptions, along GST rate on the legal services furnished via distinct service providers.

GST Applicability on the Advocates, Senior Advocates & Firm of Advocates

Legal services are classified under the services that lawyers or advocates have furnished concerning the consultancy or assistance in any branch of law in any way, and consist of the representational services in any court or tribunal. On furnishing legal services, a GST shall be applicable.

Professional and CA,CS & Accounting Websites for Your Firm

Need for Registration of GST

GST registration would be needed when the advocate, senior advocate, or firm of advocate furnishes the legal services (exempt and taxable services) and fulfils one or both of the mentioned below conditions:

- Turnover of more than the GST registration limit

- The tax would be paid on a forward charge

When legal services would be furnished to a corporate body, including a turnover of more than Rs 40 lakh, on the basis of reverse charge, the GST would be applied.

Taxability Related to Legal Services:

- For the individual advocate or firm of advocates: When the services would b furnished to the corporate body with a gross turnover of more than the registration limit. The same would be subjected to be applied on a reverse charge basis.

- For the case of a senior advocate, when the service would be provided to

- Individual advocates or firms of advocates

- Senior advocate

- To a corporate body with a gross turnover exceeding the registration threshold.

However, there are some cases in which the legal services furnished would be exempt, which would have been described in the below-mentioned topic.

Exemptions for Advocates, Senior Advocates, and a Firm of Advocates

Mentioned below would be the exemptions available for the advocates, senior advocates, and firms of advocates to furnish the legal services vide notification no.12/2017 Central Tax:

👉🏿 1. Individual advocate or firm service provider: These legal services would be exempt when the same is furnished to:

- Individual advocates or firms of advocates

- Senior advocate

- To a business entity that would qualify for exemption from registration under the CGST Act, 2017.

- To any government entity

- Non-business entity

👉🏿 2. Services furnished via senior advocate: These legal services would be exempt when they get furnished to

- To a business entity qualified for exemption from registration under the CGST Act, 2017.

- To any government entity

- Non-business entity

GST rates and HSN or SAC codes for Advocates, Senior Advocates & Firms of Advocates

| SAC | Service Description | SGST | CGST | IGST |

| 9982 | Legal and accounting services | 9% | 9% | 18% |

Recommended: Most Important Things to Know When Building a Lawyer Website

Exemptions

Not all legal services are taxable under GST. There are certain services that have been exempted or zero-rated under GST. These services include those offered by law firms or an individual lawyer (excluding senior advocates) to:

- A person who does not own a business.

- An individual advocate or a partnership firm of advocates.

- A business entity with a previous annual turnover not exceeding Rs. 20 lakh.

The following services by a Senior Advocate are exempted under GST

- Legal Services to a person other than a business entity, or

- Legal Services to a business entity with a previous annual turnover not exceeding Rs. 20 lakh.

Must Read: Important Things To Remember Before Hiring A Lawyer For Business

What is the Reverse Charge Mechanism?

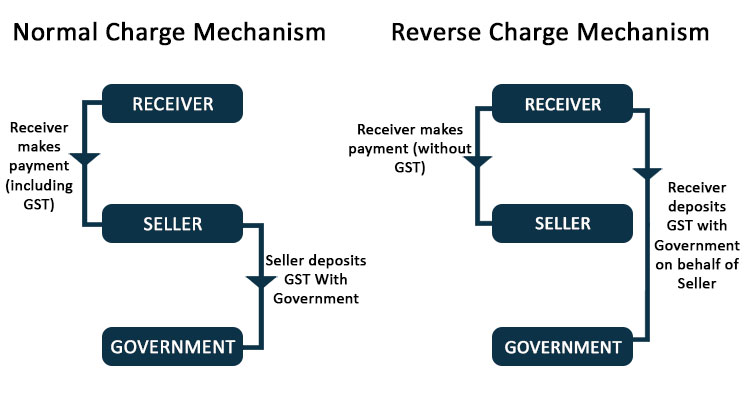

In simple terms, RCM or Reverse Charge Mechanism is an anti-Tax evasion mechanism under GST. Primarily, GST is levied on every stage of value addition and is collected by the manufacturer, seller or service provider from the consumer or recipient. Post output liability adjustment, the tax is deposited by the manufacturer or service provider with the Indian Tax Authority.

Under RCM, the participant roles are reversed. This means the consumer or recipient is liable for tax payments. Section 9(3) of the Central Goods and Services Tax Act, 2017 directs the recipient of Goods or Services to deposit the liable tax with the government.

In August 2017, the GST Council clarified that tax will be levied according to the Reverse Charge Mechanism against services provided by lawyers, including Senior Advocates and law firms. This means that GST on legal fees will be payable by the recipient of the legal service and not the service provider. The same has been stated by the Finance Ministry too. As per the Finance Ministry, Lawyers with a gross annual income greater than Rs. 20 lakhs need to get registered under the reverse charge mechanism of the GST system for legal services provided by them.

Hence, legal services like client representation before any court, tribunal or authority are liable under GST. But it is the client who needs to pay the service tax, depending on the territory and the consulting lawyer/firm charges. A writ petition for the same was filed by J.K. Mittal and Company. In it, the law firm challenged the validity of the ‘reverse charge mechanism on lawyers. However, the Finance Ministry clearly stated that GST liability against legal services procured from an individual lawyer (including senior advocates) is the sole liability of the client or recipient of the service. Further, RCM is also liable against outsourced legal services where legal services are hired from a particular lawyer or law firm, but services are provided by a third-party advocate or law firm in a different territory.