It is necessary for each company to furnish the annual accounts and annual returns according to the Companies Act, 2013. The ROC filing is administered under Section 129 (3), 137, of The Companies Act, 2013, along with Rule 12 of the Company (Accounts) Rules, 2014. Under this head, the annual return is administered under Section 92 of the Companies Act, 2013 and Rule 11 of the Companies (Management and Administration) Rules, 2014. Below is the ROC compliance calendar for the 2024-25 fiscal year. Please keep track of the ROC annual return filing due date in FY 2024-25 as per the provided compliance calendar.

Under the Companies Act of 2013, every registered company is required to submit its financial reports and annual updates to the Registrar of Companies (ROC). This comprises completing specific forms: Form AOC-4 for financial statements and Form MGT-7 or MGT-7A for the annual return. Likewise, Limited Liability Partnerships (LLPs) registered under the Limited Liability Partnership Act of 2008 should file their financial statements using Form LLP-8 and their annual return with Form LLP-11. These filings need to be done on time, following the stated due dates of the law.

In the ROC annual return filing under income tax return, there is a provision of penalties and additional fees, which vary on the period of delay in return filing. Also, stakeholders can file company law e-forms via the ROC software with the automatic fetching feature.

A Comprehensive Overview of ROC Compliance

Every registered company or Limited Liability Partnership (LLP) in India is required to submit important reports each year, known as ROC compliances. These reports provide an overview of the company’s activities and operations as mandated by the Companies Act of 2013. It’s essential for companies and LLPs to file these documents with the Registrar of Companies (ROC) on time. If they miss the deadline, they may face pay penalties.

Purpose of ROC Annual Return (Form MGT-7):

The purpose of the ROC Annual Return is given below:

Statutory Compliance: The objective of filing ROC annual returns for FY 2024-25 is to ensure statutory compliance with the Companies Act, 2013. It acts as a legal obligation that all registered companies must fulfil.

Transparency: The filing of the ROC annual return for FY 2024-25 encourages transparency and accountability by furnishing precise information concerning the company’s financial health, governance structure, and ownership.

Public Disclosure: Certain information contained in the filing of the ROC annual return for FY 2024-25 is available for public inspection, permitting stakeholders, investors, and creditors to make informed decisions for the company.

Why Are ROC Filings Essential?

- Legal Compliance: Under the Companies Act, 2013, ROC filing is mandatory, allowing companies to avoid penalties and maintain their legal status.

- Transparency and Trust: By revealing vital information about the company’s processes and financial health,h it ensures clarity, building trust among stakeholders.

- Corporate Governance: Regular filings report influential changes like directorship alterations and shareholding patterns, supporting effective governance.

- Financial Health Assessment: Financial statements filed with the ROC deliver insights into the financial stability of the company, aiding stakeholders in making informed decisions.

- Statutory Record Keeping: ROC filings maintain a legal record of a company’s historical data, critical for legal referencing and historical analysis.

- Risk Mitigation: Timely filings assist in lessening the risks related to non-compliance, like penalties or potential deregistration, improving the market credibility of the company.

What is the ROC Annual Return for FY 2024-25?

The ROC Annual Return, also called Form MGT 7, is a filing obligation for companies registered in India according to the Companies Act, 2013. The ROC Annual Return, also called Form MGT 7, is a filing obligation for companies registered in India under the Companies Act of 2013. It acts as a document that includes details of the financial and operational activities of the company within a particular financial year. Submitting the ROC return for FY 2024- 25 is an element of complying with corporate regulations in India. It is to be accomplished within the specified time duration of the Registrar of Companies (ROC).

Extended Due Dates of ROC Annual Return Filing for FY 2024-25

It is obligatory for every company registered under the Companies Act, 2013, and every LLP registered under the Limited Liability Partnership Act, 2008, to furnish all ROC filing forms before the deadline. If they fail to do so, there are lawful consequences and hefty fines. Hence, it must be of utmost priority for companies and LLPs to keep themselves aware of all significant deadlines, along with both annual and even ROC compliance.

Given below is the All ROC compliance calendar for regular and annual returns during FY 2024-25

| Relevant Section and Act | Name of E-form | Purpose of E-form | Due Date of Filing | Due Date for FY 2024-25 |

|---|---|---|---|---|

| Section 139 of Companies Act, 2013 | Form ADT-1 | Appointment of Auditor | (if applicable) 15 days of the meeting in which the auditor is appointed | 14th Oct. 2025 (*If appointed at the Annual General Meeting on 30th Sep. 2025). |

| Section 137 of the Companies Act, 2013 | Form AOC-4 and Form AOC-4 CFS (in case of consolidated financial statements) | Filing of Annual Accounts | 30 days from the conclusion of the AGM (In the case of OPC within 180 days from the close of the financial year) | 30 days after the conclusion of AGM or 31st January 2026 (whichever is earlier) |

| Section 92 of the Companies Act, 2013 | Form MGT-7/ MGT-7A | Filing of Annual Return | 60 days from the conclusion of the AGM | 60 days from the conclusion of the AGM or (Which Ever is Earlier) |

| Section 148 of the Companies Act, 2013 | Form CRA-4 | Filing of Cost Audit Report | 31st January 2026 (Revised) | 30 days from the receipt of Cost Audit Report |

| Section 179 of the Companies Act, 2013 | Form MGT-14 | Filing of resolutions with MCA regarding Board Report and Annual Accounts | 30 days from the date of financial statements and Board Report by the Board of Directors | 30 days from the date of the Board Meeting |

| Vide Gazette notification S.O. 5622(E) dated 02.11.2018 | MSME Form 1 | Half-yearly return with the registrar in respect of outstanding payments to Micro or Small Enterprise. | For reporting dues to MSME exceeding 45 days, if any on a half- yearly basis | 30th April 2025 (October- March Period) And 31st October 2025 (April-September Period) |

| Section 34 of Limited Liability Partnership Act, 2008 | MCA LLP FORM 8 | Statement of Accounts of LLP | The Statement of Account and Solvency must be submitted within thirty days from the end of Six months of the financial year. | 30th October 2025 |

| Section 35 of Limited Liability Partnership Act, 2008 | MCA LLP Form 11 | Annual Return | Within 60 days of closure of the financial year | 30th May 2025 |

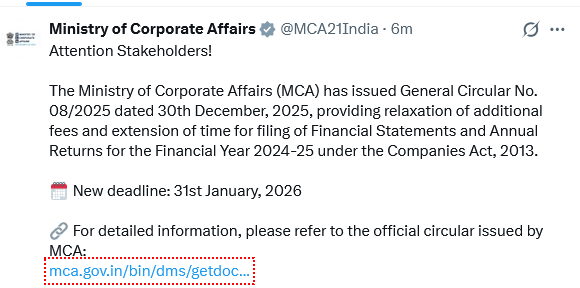

Latest Update:

- General Circular No. 08/2025 pertains to MGT-7, MGT-7A, AOC-4, AOC-4 CFS, AOC-4 NBFC (Ind AS), AOC-4 CFS NBFC (Ind AS), and AOC-4 (XBRL). Please refer to the Circular for details. Read Circular

- “General Circular No. 06/2025 pertains to MGT-7, MGT-7A, AOC-4, AOC-4 CFS, AOC-4 NBFC (Ind AS), AOC-4 CFS NBFC (Ind AS), and AOC-4 (XBRL). Please refer to the Circular for details.” Read Circular

- “General Circular No. 07/2025 for MCA form CRA-4 pertains to the Cost Audit Report in XBRL format.” Read Circular

Due Date for AOC-4 NBFC (Ind AS) and AOC-4 CFS NBFC (Ind AS)

The Ministry of Corporate Affairs (MCA) has provided a one-time relaxation, allowing companies to file their annual financial statements (Forms AOC-4, AOC-4 CFS, AOC-4 XBRL, etc.) and Annual Returns (Forms MGT-7/MGT-7A) for the Financial Year 2024-25 until 31st January 2026 without attracting any additional filing fees.

Also, it is to be noted that the Ministry of Corporate Affairs has extended the dates for the annual general meetings for companies and advised to conduct the same via video conferencing of possible. To know more about the latest AGM provisions, check out https://blog.saginfotech.com/agm-due-date-new-company

Latest Notifications Under MCA for Companies

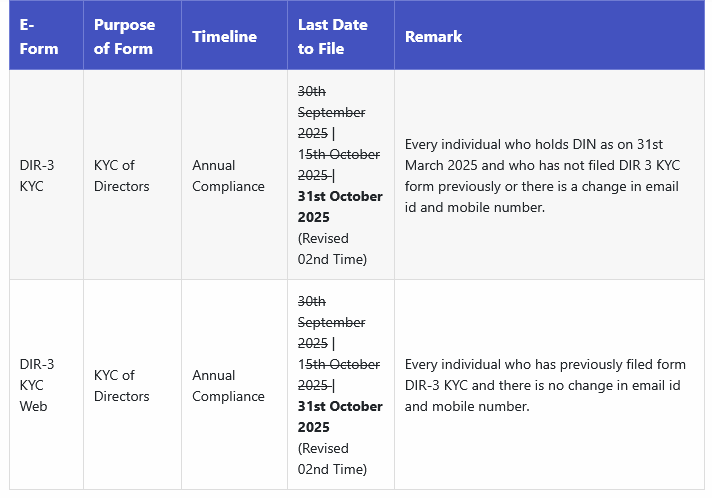

- The Ministry of Corporate Affairs (MCA) has updated the Know Your Customer (KYC) regulations for directors. Filings for DIR-3 KYC and DIR-3 KYC Web are now required once every three years. Read PDF

- Additionally, the MCA has issued Notification G.S.R. 940(E), which pertains to the Amendment Rules for the removal of company names from the Register of Companies for 2025. Read PDF

- The Ministry of Finance has revised the due date for e-Forms MGT 7, MGT 7A, AOC 4 CFS NBFC (Ind AS), AOC 4 (XBRL), AOC-4, AOC-4 CFS, and AOC-4 NBFC (Ind AS) to December 31, 2025, for FY 2024-25. Read Notification

- MCA has announced that there will be no additional fee for filing these 13 specific e-forms. Read the Circular.

- The Ministry of Corporate Affairs (MCA) issued General Circular No. 05/2025 on October 15, 2025, extending the deadline for e-form DIR-3-KYC and web-form DIR-3-KYC-WEB filings without a fee until October 31, 2025. Read Circular No. 05/2025

- The MCA department has issued a circular regarding the due date extension for the filing of e-forms AOC-4, AOC-4 (CFS), AOC-4 XBRL AOC-4 Non-XBRL till 15th March 2022 and MGT-7, and MGT-7A till 31st March 2022. Read new circular.

- “Gap between two board meetings under section 173 of the Companies Act, 2013 (CA-13) – Clarification – reg.” Read PDF

- “Relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013.” Read PDF

Penalty/Additional Fees

“Additional Fees for E-form AOC-4 (XBRL and Non-XBRL) and E-form MGT-7 after the due date are Rs. 100 per day with effect from 1st July 2018.”

In addition to the above, the following table of additional fees shall be applicable for delays in filing of belated annual returns or balance sheet/financial statement under the Companies Act, 1956 or the Companies Act, 2013 up to 30/06/2018:

For other forms or documents, the following fee structure is Usable with every delay in filing the form:

| Period of Delays | Fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days and up to 60 days | 4 times of normal fees |

| More than 60 days and up to 90 days | 6 times of normal fees |

| More than 90 days and up to 180 days | 10 times of normal fees |

| More than 180 days and up to 270 days | 12 times of normal fees |

June 6, 2020

Company incorporated in Feb 2019. Annual return has not been filed till now for FY 2018-19. What can be done now?

Late fee will be huge if AOC4 and MGT14 filed now right?

June 9, 2020

You can file aoc-4 and mgt-7 for f.Y 2018-19 without late fees under cfss scheme.2020 as per cfss scheme 2020 issued by mca, mca has waived off penalty for aoc-4 and mgt-7 and normal fees for the same will be charged for further details kindly contact any practicing professional.

June 9, 2020

Thank you very much

January 29, 2020

My company was incorporated in 9 Jan 2019 but I have to close my company but I was not filling roc I was closed my gst and bank account what to do now

January 30, 2020

If company has not commenced or has not done any business then you can strike off the company by filing form stk-2 with other relevant forms and documents. For detail process of strike off kindly contact your concerned practicing professional.

January 20, 2020

You can conduct 1st AGM 9 months from the closure of F.Y. 18-19,

hence AGM date can be 31.12.2019. ADT-1 is required to be filed within 15 days from the date of AGM i.e. 14.01.2020, AOC-4 is required to be filed within 30 days from the date of AGM i.e. 29.01.2020 and MGT-7 is required to be filed within 60 days from the date of AGM i.e. 28.02.2020.

December 4, 2019

DUE DATES FOR THE FIRST TIME FILLING WITH ROC ?.

MY COMPANY WAS INCORPORATED ON 11TH JAN 2018.

SO, ANY ONE CAN EXPLAIN ME WHAT ARE THE DUEDATES FOR FIRST TIME ANNUAL RETURNS FILLING WITH ROC?

December 4, 2019

Here the first financial year would be 2018-19 for which AGM can be held within nine months from the closure of financial year. Accordingly annual filing shall be done on the basis of the AGM date. ie. Form AOC-4 with in 30 days and MGT-7 within 60 days.

June 18, 2018

What is the reasonable Professional fee for filing ROC returns only.

What is the fee for filing Income tax returns and ROC returns Fee of a CA

The Company is private limited company with capita of Rs 100000/- only

Pl inform as early as possible.