In the Indian tax ecosystem, Chartered Accountants (CAs) secures an important space, proposing support to individuals and businesses in handling their tax filings. The older method of managing tax filing could become inefficient with the rise in the volume of clients and complex tax regulations. Hence unlimited ITR filing software can furnish a significant tool for CAs, delivering a multitude of advantages that improve efficiency, accuracy, and client satisfaction.

CAs are enabled to facilitate their tax filing operations via the usage of the unlimited ITR filing software which makes them unable to manage a higher volume of clients. The same software eases the tax filing procedure lessening the time and effort needed to finish the tax returns, along with ensuring accuracy and compliance with the updated tax laws.

In What Way Can Advanced ITR Filing Software Revolutionise the Process?

Through the method of integration of distinct financial information sources and removing the requirement for manual data entry, Advanced ITR filing software can revolutionize the income tax returns filing procedure such software could save time and diminish errors. They could assist the assesses in finding out the deductions and credits that may have been forgotten.

Adopting advanced ITR filing software benefits taxpayers and tax authorities by streamlining the process and improving accuracy and transparency.

#1. Ever-Changing Tax Laws and Complexities

The tax laws in India are known for being very complicated and are often changed frequently. For individuals who aren’t familiar with tax intricacies, keeping up with these changes can be a daunting task. However, advanced software can make things easier by automatically integrating the latest tax laws and updates. This ensures that calculations are accurate and compliance is maintained.

#2. Efficient Data Management

In the modern world, there is a huge amount of financial data that needs to be collected and organized for filing Income Tax Returns (ITR). This data includes salary slips, investment statements, interest certificates, and more. Manual collation and organization of this information can be time-consuming and error-prone. However, advanced software now offers data import features from different sources such as banks and investment platforms, which streamlines the process and minimizes data entry errors.

Read Also: Main Role of CA Professionals for Ease of TDS Compliance

#3. Accounting Systems Incorporation

Integrating tax filing software with accounting systems can be highly beneficial for entrepreneurs and investors. Through the same execution, the need for duplicate data entry is eradicated, resulting in an easier and more efficient financial recording process.

Integrating both systems can bring consistency in financial records, which can help in managing the business or investments effectively. It enables informed decision-making and saves time by reducing the risk of errors, making the overall process more reliable and accurate.

#4. Intelligent Tax Deduction and Exemption Management

Optimizing your tax liability is important, and one way to do that is by taking advantage of all the tax deductions and exemptions available to you. Identifying these benefits can be complicated, but advanced software can help. By using intelligent algorithms, this software can scan your financial data and suggest relevant deductions and exemptions, ultimately maximizing your tax savings.

#5. Managing Income From Different Sources

Individuals with income from different sources such as salaries, rentals, investments, or freelance work face a more complex tax filing process. Advanced software can help manage multiple income streams and accurately calculate taxes for each source.

#6. ITR Error Detection and Prevention

Minor errors in ITR may result in processing delays, penalties, or tax authority scrutiny. Advanced software utilizes error-checking mechanisms to identify inconsistencies and potential mistakes before submission, ensuring accuracy.

#7. Complete Audit Trail and Record-keeping

Keeping a clear and complete audit trail is crucial in case of a tax audit. It allows you to present a well-organized report of your income tax return filing history, which includes all necessary supporting documents and calculations. Utilizing advanced software can be extremely beneficial in automatically generating this audit trail.

The same could compile all the required data in one place which makes it simpler to access. Through the same way you could save substantial time and effort assuring that financial records are accurate and in compliance with the norms.

#8. Keeps Different ITR Forms

The Income Tax Department uses different ITR forms based on an individual’s income. Advanced software guides users in selecting the appropriate form and provides tailored filing instructions.

#9. Personalized Support and Secure Environment

Tax filing can be a complex process that may lead to questions. An ideal software solution should provide access to reliable support channels, including email, chat, or phone consultations with tax professionals. In addition, it is crucial to have robust security features to safeguard sensitive financial data.

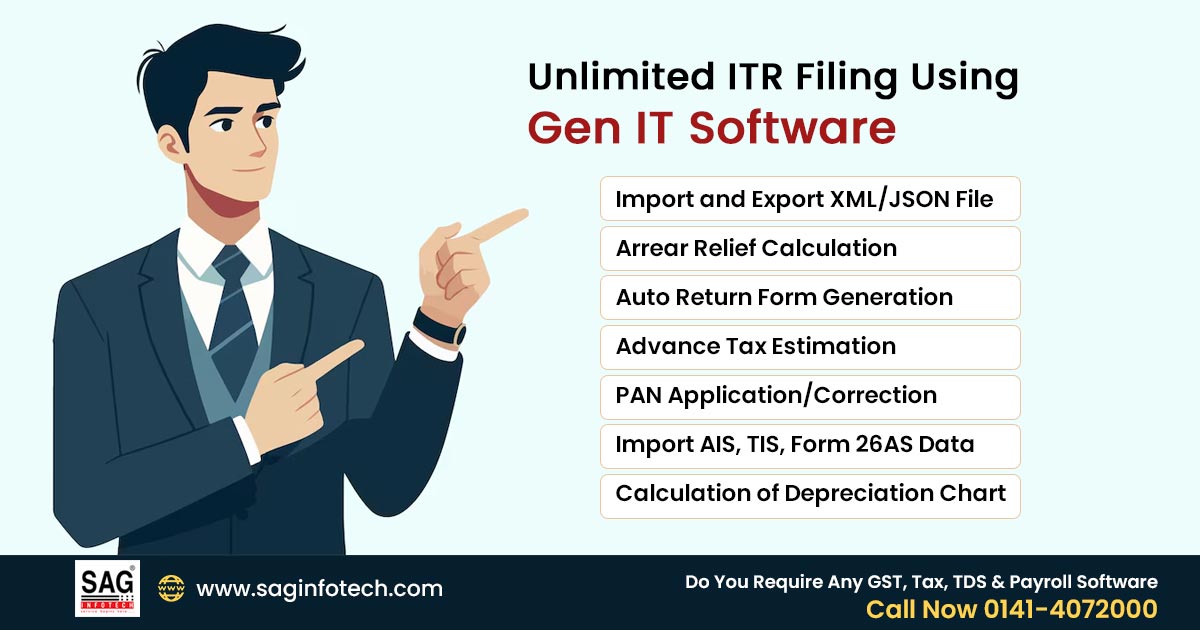

Streamline Your Tax Filing with Gen Income Tax Software

ITR filing could consume more time and is a complex process. However, the unlimited Gen Income tax software eliminates the filing hurdle and assists you in computing your taxes efficiently and accurately. The same saves everything from fetching your income tax, Self Assessment Tax, and Advance Tax to calculating interest under sections 234A, 234B, and 234C.

The software automatically chooses the pertinent return form, generates XML or JSON tax formats, calculates arrear relief, and lets you import your income details and master data. You can e-file your return through the software itself.

However, Gen IT Software is more than just return filing. It combines with the Income Tax Department (ITD) web services, proposing advanced functionalities such as MAT/AMT calculation, income and deduction summaries, and even faster ITR uploading. To navigate the entire tax filing process, the same solution empowers both taxpayers and tax professionals.

Conclusion: It is important to note that while basic online portals can be a good starting point for filing Income Tax Returns (ITR), advanced software solutions offer many more benefits. These tools can help navigate complex deductions, ensure accuracy and compliance, and empower individuals and businesses to optimize their tax filing experience in today’s ever-evolving tax landscape. So, next time you file your ITR, consider leveraging the power of advanced software for a smoother, more efficient, and potentially more tax-saving journey.