Employee Company Secretaries Identification Number refers to a unique number that every member of the Institute of Company Secretaries of India who is employed in a company has to mandatorily generate at the time of appointment as well as resignation unless guidelines do not exempt the same.

Recently, ICSI issued the ICSI Guidelines, 2019 which states the mandatory generation of the eCSIN. These guidelines became effective on October 01, 2019.

The central aim behind eCSIN is to increase transparency by identifying the organisations wherein Company Secretaries are hired and the appointment of CS’s in a job in consonance with Section 203 of the Companies Act. Therefore, all company secretaries should hold eCSIN number mandatorily from 1st October 2019. In this article, we look at the eCSIN in detail.

Applicability of eCSIN

eCSIN has to be generated by a company secretary

- At the time of employment

- At the time of termination from office – resignation, retirement, disqualification or removal.

Mandatory Furnishing of eCSIN

eCSIN has to be mandatorily quoted on the following documents:

- The consent letter by any ICSI member who is getting appointed as a company secretary.

- The consent letter is to be affixed with the Form DIR-12 by the members getting employed as company secretary w.e.f 1st October 2019.

Note: It is mandatory to generate eCSIN on or before 31st December 2019 for the members who have already furnished form DIR-12 as per the companies act.

eCSIN Generation

It is mandatory for every company secretary to generate eCSIN at the time of issuing the consent letter/resignation letter/cessation letter to the employer, until not exempted under the guidelines.

eCSIN is issued by or generated on the request made by the member of the competent authority of eCSIN . The authority is responsible for the allotment, exemption, alteration and generation of eCSIN. Besides, the concerned officials will generate eCSIN w.r.t any member or group of members, including the members excluded by the guidelines.

Exemption of eCSIN

The mandatory generation of eCSIN or the provisions of eCSIN do not apply to the following ICSI members i.e. they are exempted from the generation of eCSIN.

- Any members of Parliament or State or UT Legislative Assembly

- Any members of Judiciary or Tribunals and Quasi-Judicial bodies

- Any members of Armed Forces and Paramilitary forces

- Any members of Civil services and allied disciplines.

- Any members registered with the registered bar council of India

- Any members working in Central Government, State Government, Regulatory bodies, Government organisations.

- Any members have a certificate issued by any other professional in India.

- ICSI members are exclusively exempted by the ICSI council.

Information Required For The Generation of eCSIN

Details required to generate eCSIN are as follows:

- Membership Number

- CIN Number of Employer

- Employee’s Designation

- Registration Number of employer

- Date of Offer Letter

- Date of Consent Letter

- Date of Appointment

- Date of Registration Notice

- Date of Employment Termination Notice

- Date of Employment Cessation

Process of Online Registration for eCSIN

Here is the step-by-step process for the corporate secretaries to generate eCSIN

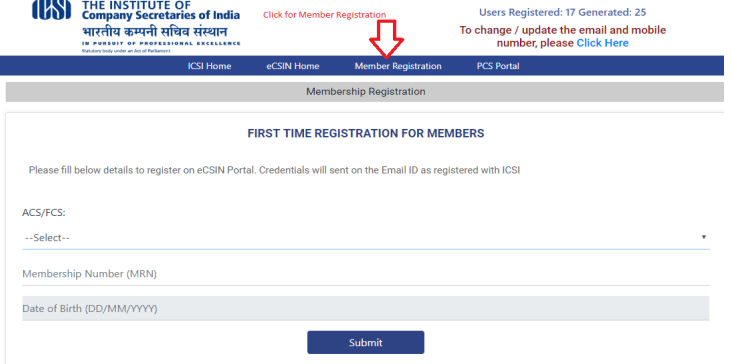

Step 1: Click on the “Membership Registration” menu and register yourself on the eCSIN portal.

Step 2: Opt for either ACS or FCS and furnish the details like member’s registration number, DOB, etc.

Step 3: Click on the “Submit” button.

Step 4: ACF or FCS registered members of eCSIN portal have to log in by filling in the user name & password and clicking on the “Login” button.

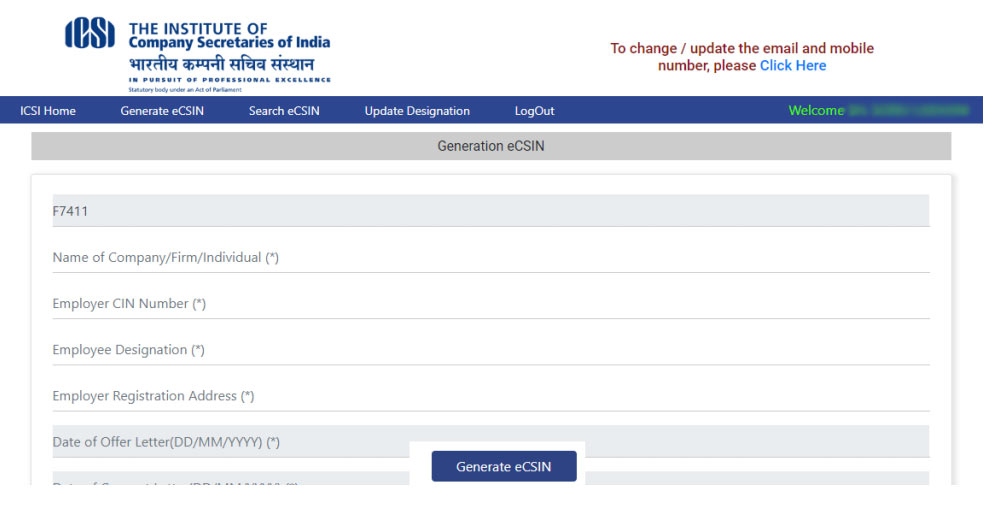

Step 5: Now you are redirected to the eCSIN generation page.

Step 6: Ensure that your Registration number gets auto-populated and fill all the fields of the eCSIN generation.

Step 7: Click on “Generate eCSIN” button.

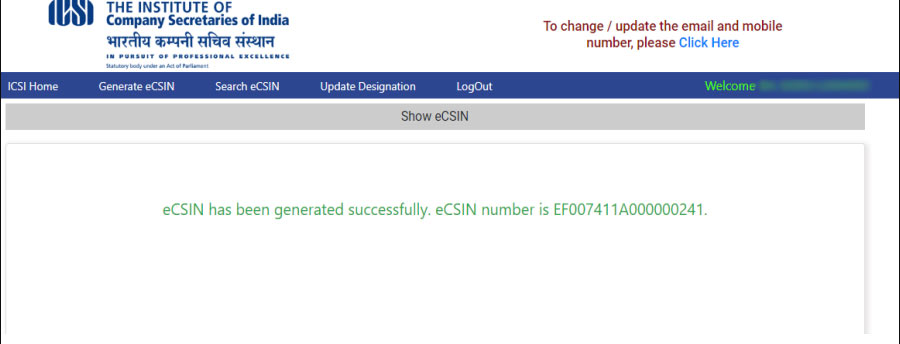

Step 8: Registration successful, check the status message or email which is sent to the registered email id of the member on successful registration.

Note: One member can generate only one eCSIN. For the generation of new eCSIN number, the existing number needs to be revoked by the member.

Search eCSIN

A member can see the eCSIN number list or search the eCSIN number.

Step 1: Enter the starting as well as ending date to discover the eCSIN number generated.

Step 2: Both active, as well as inactive eCSIN numbers, will be listed on the screen.

Step 3: Download all the active or inactive eCSIN numbers (if you want).

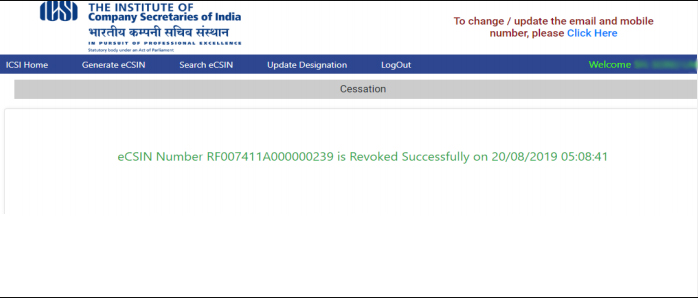

eCSIN Cessation or Revocation

Steps to revoke the eCSIN number are as follows:

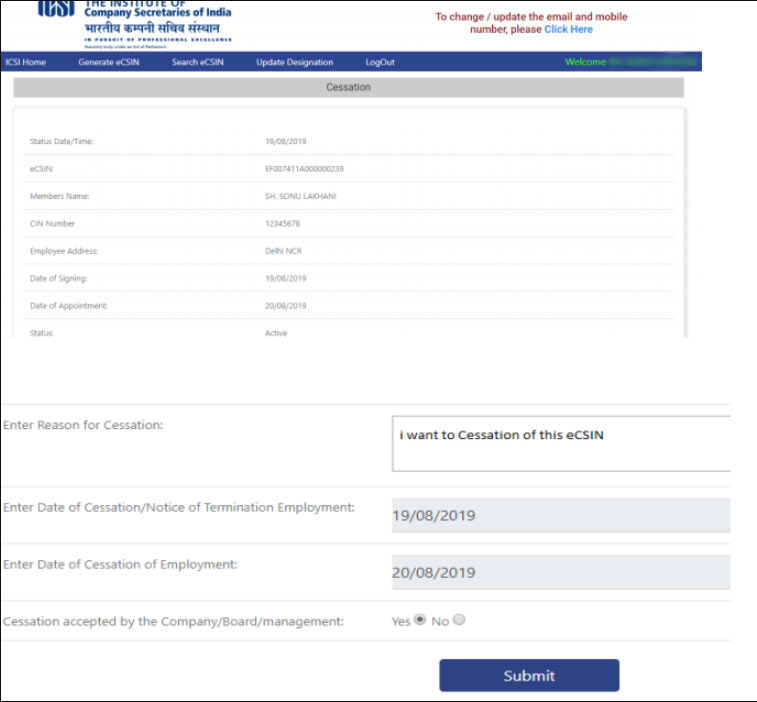

Step 1: Search for the active eCSIN numbers > click on the “Cessation eCSIN” button.

Step 2: Furnish the details like the date of cessation of employment reason for cessation and notice of employment termination.

Step 3: Click on the “Submit” button and get the updated status of cessation.

Detailed FAQs Based on ICSI eCSIN

Detailed Frequently Asked Questions(FAQ) Based on ICSI eCSIN

Q 1. What is the meaning of Employee Company Secretary Identification Number (eCSIN)?

Employee Company Secretary Identification Number is 17 digit alphanumeric number which allows ISCI to identify a Company Secretary employed in a specific company and hence brings transparency.

Q 2. What is the main objective of Employee Company Secretary Identification Number (eCSIN)?

The Company Secretaries Act, 1980 takes initiative to regulate and manage the Company Secretary profession. The latest guidelines issued by ICSI eases the identification of the Company Secretary working in a particular company and increases the transparency.

Besides, this is inevitably going to facilitate the members to update their office address in the Register of Members to be kept up by the Institute as per Regulation 3 of The Company Secretaries Regulations, 1982.

Q 3. Is there any charge applicable for the generation of eCSIN?

Generation of eCSIN is free of cost service.

Q 4. How eCSIN is generated?

Only an ICSI member can generate and maintain the eCSIN and that too only at the eCSIN portal. The eCSIN is issued electronically by the Institute on the registered email id of the member.

Q 5. Which details are needed for eCSIN generation?

Details needed to generate eCSIN are as follows:

- Membership Number

- Employer CIN Number

- Employer Registration Numbe

- Employee Designation

- Date of Offer Letter

- Date of Consent Letter

- Date of Appointment

- Date of Notice of Registration/ Date of Notice of Termination of Employment

- Date of Cessation of Employment

Q 6. When an eCSIN should be generated?

An ICSI member should generate an eCSIN at the time of issuing the consent letter or the resignation/cessation letter to the employer for any employment under any organization, as a Company Secretary or otherwise unless exempted as per clause 6 of these Guidelines.

Given that the concerned authority of ICSI may assign, exempt, change or otherwise preside over the generation of eCSIN on a member’s special request under special circumstances as specified under the prevailing law or otherwise.

Besides, it is also provided that the Concerned Authority may suo motu generate eCSIN pertaining to any member or group of members encompassing the members exempted as per clause 6 of these Guidelines.

Q 7. What are the circumstances under which eCSIN is Mandatory?

It is mandatory to quote eCSIN on the consent letter for the ICSI members when they are entering into any employment as a CS (KMP) or otherwise.

Another situation under which quoting of eCSIN is mandatory on the consent letters to be affixed with the form DIR 12 is when the ICSI members enter into employment as CS w.e.f. 1st October 2019 and till that date, the same remains mandatory.

Members entering into employment as CS or ceasing from it as Company Secretary (KMP) w.r.f 1st October 2019, shall mandatorily generate eCSIN and mention the same on the related consent/resignation letter, which needs to be attached with e-form DIR-12.

Q 8. What are the exemption of the requirement of eCSIN?

The requirement of eCSIN generation are not applicable to the members who are acting as-

- Sitting Members of Parliament or of any State or UT Legislative Assembly

- Employer CIN Number

- Serving Members of Civil Services and allied disciplines

- Serving Members of Judiciary/Tribunals and Quasi Judicial Bodies

- Serving Members of Armed Forces and Paramilitary forces

- Members in permanent employment with Central Government, State Government(s), Regulatory Bodies, Government Organizations

- Date of Appointment

- Members holding Certificate of Practice issued by any other professional bodies in India

- Members registered with any registered Bar Council of India.

- Members who are exclusively exempted by the ICSI Council on case to case basis.

Q 9. Is it compulsory to generate eCSIN for the members for whom form 32 under the provisions of firmer Companies Act, 1956 or form DIR-12 under the provisions of the Companies Act, 2013 has been filed up to and on 30th September 2019?

Yes, it is compulsory to generate eCSIN on or before 31st December 2019.

Q 10. How a new password is generated when the member forgets the password?

A new password can be generated by clicking on the → “Forgot Password link” and furnishing the membership number along with the date of birth. A new password will be sent to the email id of the member registered with ICSI.

Q 11. What does an ICSI member need to do to Update Designation?

An ICSI member can update his/her designation using the Update Designation menu and providing the details for the below-mentioned fields.

- New Designation of the employee

- Date of Change in Designation (DD/MM/YYY)

Click on “Update eCSIN” Button to update the respective eCSIN.

Q 12. What is the procedure to revoke eCSIN ?

The user can revoke the eCSIN using the Cessation functionality. For this, the user needs to search for the active eCSIN numbers and click on the “Cessation eCSIN” button to revoke the active number.

Details that the user needs to provide in the Cessation page are as follows:

- Reason for Cessation – mention the reason for cessation in the respective field

- Date of Cessation/Notice of Termination Employment

- Date of Cessation of Employment

After furnishing these details, the user needs to click on the “Submit” button for the Cessation. After that, the user gets notified about the updated status.

Q 13. What is the process to Search all the eCSIN generated by members?

To view the eCSIN number list, the user needs to enter the start and end date to and this will display a list of all the active and inactive eCSIN numbers.

The user has been provided an option to download all the eCSIN numbers both in active/inactive status.

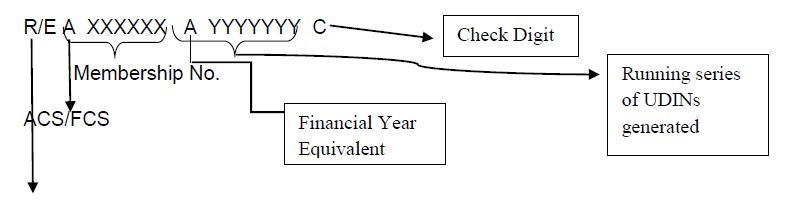

Q 14.What does the 17 digits of eCSIN signify?

The format of the eCSIN signifies:

- R represents Cessation

- E represents Employment

- A signifies ACS and F signifies FCS i.e. the Status of Member

- XXXXXX is the professional’s Membership Number

- A represents the Financial Year (equivalent to 2019-20, B equivalent to 2020-21, C equivalent to 2021-22,)

- YYYYYYY is Running series of UDINs generated

- C represents the Check digit

- 1+1+6+1+7+1=17 digits

Where –

Q 15. If the ICAI member has been appointed as CS in a company and has generated eCSIN and subsequently appointed as CS in one of its subsidiary company, what he must do in such case?

Para 4 of the eCSIN Guidelines states that the Competent Authority may allot, exempt, alter or otherwise deal with the generation of eCSIN on a particular request of a member under special circumstances which may be needed as per laws prevailing or otherwise.