GSTR 9A form filing due date and annual return form for the composition scheme dealers which they have to file before the due date along with tax return details of the whole year. The GSTR 9A form includes all the consolidated information regarding CGST, SGST and IGST paid during the financial year.

Here, we will describe the complete details of the GSTR 9A form under GST which is for composition scheme dealers and its rules/eligibility. We request you to connect with us in the comment section and ask for answers related to the complete GST regime from our tax experts.

Extended GSTR 9A Form Filing Due Date For FY 2018-19and 2019-20:

| GSTR 9A Composition Annual Return | Due date |

|---|---|

| FY 2017-18 | 31st January 2020 (Date Showing After Login on GST Portal) |

| FY 2018-19 | 31st December 2020 Extended Check gst.gov.in |

| FY 2019-20 | 31st December 2020 |

Extension Official Notification: Extension Official Notification: “The Central Board of Indirect Taxes and Customs ( CBIC ) has extended of filing GSTR 9/9A/9C FY 2018-19 till 31st December 2020”. Read Press Release

Find a complete step-by-step guide to file GSTR 9A along with guided screenshots for the taxpayers here.

Complete Details of GSTR 9A Form Under GST:

GSTR 9 Annual return filing form is under GST for the composition scheme businessman. All the taxes paid in the financial year under the SGST, CGST and IGST head are accounted for in the form with their consolidated details.

Who is Required to File the GSTR 9A Annual Return Form (Composition):

Eligibility for Filing GSTR 9A :

All the composition scheme dealers are required to file the GSTR 9A form yearly and at the year-end.

The following entities are not required to file GSTR 9A:

- Casual Taxable Person

- Input Service Distributor

- Non-Resident Taxable Individuals

- Individuals paying TDS under section 51 of the GST Act

- E-commerce operators paying TCS under section 52 of the GST Act

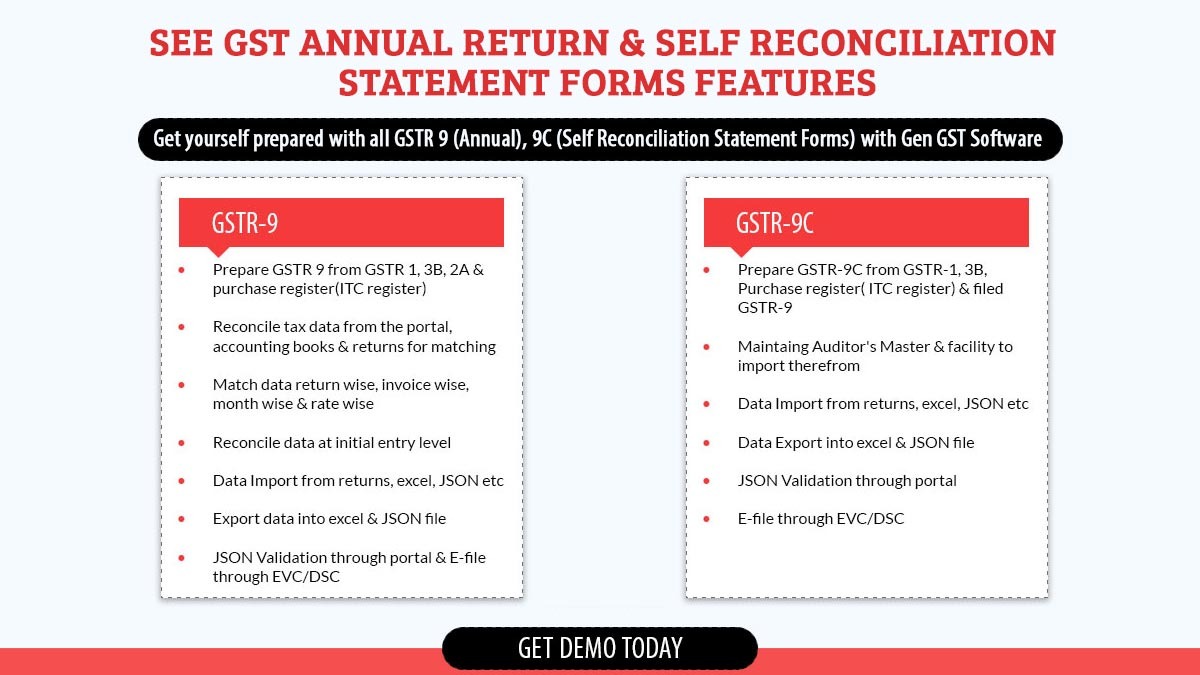

What are the Different Types of Annual GST Returns?

There are Multiple Annual Return Forms Under GST:

GSTR 9 For regular taxpayer filing GSTR-1, GSTR-2, and GSTR-3

GSTR 9A For composition scheme taxpayers

GSTR 9B For e-commerce businesses who have filed GSTR 8

GSTR 9C For those having annual turnover cross Rs. 2 crores must have to file an audit form for GSTR 9C

The Amount of Penalty on late filing of GSTR-9A

| Under GST | Under SGST/UTGST | TOTAL |

| Rs.100 per day until the delay continues. | Rs.100 per day until the delay continues. | Rs.200 per day until the delay continues. |

Please Note: Penalty on late ITR Filing should not surpass 0.25% of total turnover in the State or Union territory under CGST/SGST/UTGST.

Details Required in GSTR-9A

| Sl. No. | Sections of GSTR-9A | Particulars |

| 1. | Sec -I | Initials such as GSTIN, Legal Name, Trade Name of the taxpayer that is auto-populated. |

| 2. | Sec- II | Details of sales and purchase listed in GSTR-4 filed during the financial year. This input consists of summary from all quarterly returns filed during the FY. |

| 3. | Sec- III | A description of tax paid, the same as mentioned in returns filed during the financial year. The section contains ax paid under headlines such as IGST, CGST, SGST, Cess, Interest, Late Fee, Penalty. |

| 4. | Sec – IV | A detailed description of sales during previous FY reported in returns of April to September of current FY or up to date of filing of annual return whichever is earlier. This segment includes summary of revisions or corrections related to entries of previous FY. changes might be additions or exclusions. |

| 5. | Sec-V | Information other than the ones mentioned above: Details of Sales and Refunds. A detailed description of tax demands from the tax department, tax paid and any balance to be paid shall be mentioned. Details of refund claimed and received, pending refund shall be mentioned. Description of credit reversed or availed – When the taxpayer shifts to composition scheme from regular or vice-versa, ITC has to be adjusted accordingly. Such details related to ITC shall be mentioned here. Details of fines (payable and paid) – Fines imposed due to late payment of tax or late filing of returns requires entry under this section. |

December 25, 2019

2017-18 ANNUAL RETURN LAST DATE KYA HAI

December 26, 2019

The last date of GSTR 9A 2017-18 annual return is 31st December 2019.