The government of the country had previously made it compulsory for all the companies ruled by Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019, to submit form PAS 6 with the Registrar of the Companies as a reconciliation of share capital audit report. The form is to be submitted within 60 days from the completion of half-year along with a fee as provided in Companies (Registration Offices and Fees) Rules 2014.

The form should be duly certified by a chartered accountant or a company secretary in practice. The form has been released and is required to be duly verified and processed by the chartered accountants in a mandatory obligation. Every chartered accountant and company secretary has to check out the complete PAS-6 form filed up for the MCA compliance as per the guidelines issued.

The company is also required to inform the depository about the successful dematerialisation.

Who Need to File MCA Form PAS 6?

All the unlisted public companies are required to file PAS 6 with the Registrar of the Companies as a reconciliation of share capital audit report, within 60 days from the completion of half-year along with a fee as provided in Companies (Registration Offices and Fees) Rules 2014, and the form must be duly certified by a company secretary or a chartered accountant in practice.

Rules for Form PAS 6

Companies (Prospectus and Allotment of Securities) Rules, 2014 says that:

- Every unlisted public company shall –

- issue the securities in a dematerialised form and no other form.

- follow and complete the dematerialisation according to the Depositories Act, 1996 and regulations.

- Every unlisted public company making any –

- offer for issue of any securities or

- buyback of securities or

- issue bonus shares should ensure that such an issue follows the provisions of the Depositories Act, 1996 and regulations.

- Every holder of securities of an unlisted public company,

- who wishes to transfer such an issue before 2nd October 2018 should get the shares dematerialised before the transfer

- who wishes to make a subscription to such an issue before 2nd October 2018 should get his shares dematerialised before the subscription.

- Every unlisted company should make the dematerialisation according to the provisions of clause (e) of sub-section (1) of section 2 of the Depositories Act, 1996 after applying the depository.

- Every unlisted public company shall ensure that –

- fees have been paid to the depository, registrar and the agent timely, according to the agreement

- should maintain the security deposit of fees to be paid to the depository and registrar of the company.

- should comply with the rules, regulations and other changes as and when issued by the regulating authorities.

Any unlisted company who was a defaulter of sub-rule (5) should not be offering any issue or buyback of securities before the payment of depository, registrar and the agent.

Details to be Required while Submitting Form PAS 6

- Corporate identity number (CI.N) of company:

- (a) Name of the Company :

(b) Address .of the registered office:

(c) E-mail id, if any:

(d) Phone Number:

- ISIN:

- Period of filing: From:

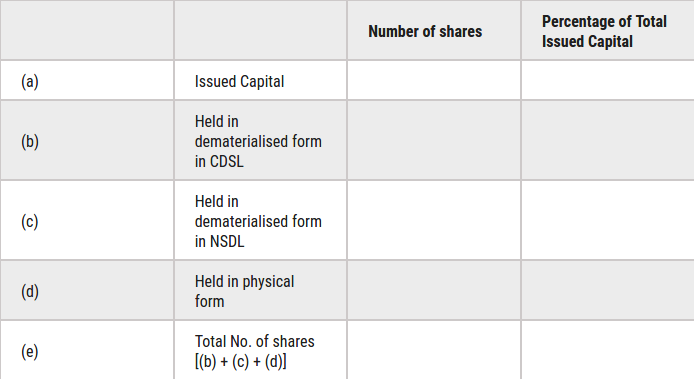

- Details of the capital of the company:

6. Reasons for difference in 5(a) and 5(e)7

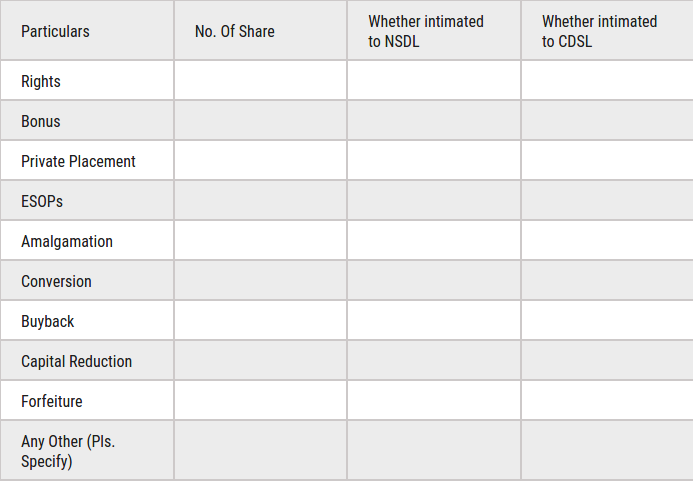

7. Details of changes in share capital during the half-year under consideration as per Table below:

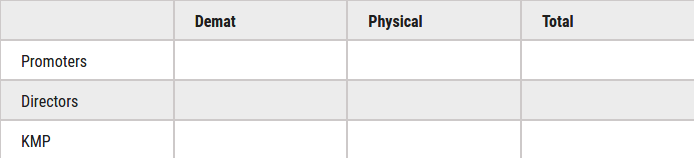

8. Details of shares held by:-

9. (a) Whether the Register of Members is updated (Yes / No ):

(b) If not, the date up to which it has been updated:

10. Whether there were dematerialised shares in excess in the previous half-yearly period (Yes/No )

11. Has the company resolved the matter mentioned in point no. 10 above in the Current half-year If not, reason why

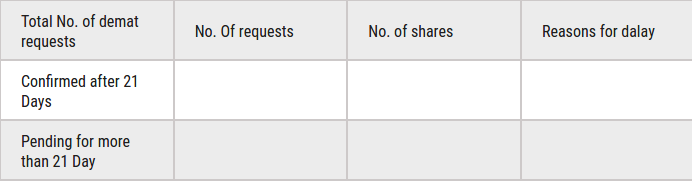

12. Mention the total no. of Demat requests, if any, confirmed after 21 days and the total no. of Demat requests pending beyond 21 days with the reasons for the delay:

13. Name, Address, E-mail and Telephone No. of the Company Secretary of the Company, if any :

14. Name, Address, E-mail, Telephone No. and Registration. no. of the CA/CS certifying this form:

15. Whether there is appointment of common agency for share registry work : If yes (Name & Address):

16. Any other detail that the professional signing this form may like to provide

SAG RTA (Registrar and Share Transfer Agent) is the agent of the company who wishes to materialise the securities and the RTA acts as an agent between the depository signing the issue and the company.

SAG RTA provides services like Rematerialisation, Dematerliasation, IPOs Issue like Right Issue, Private Placement, Buy back etc).

All the companies who wish to issue securities in dematerialised form are required to appoint a SEBI approved RTA (Registrar and Transfer Agent) who has an access to the depository. The RTA will act as a contact between both parties.

According to the recent orders of the government, every unlisted public company is required to appoint RTA to get their securities dematerialised. SAG RTA offers dematerialisation services to such companies at a nominal rate of Rs. 7000, apart from the depository charges.